Competitive

Review

In the ever-evolving markets of health and wellness, staying ahead requires strategic insights into the competitive forces shaping the playing field.

This comprehensive competitive review is meticulously curated to provide Dr.nuMe with a nuanced understanding of the weight loss industry landscape. With a focus on competitors, it provides actionable intelligence to enhance Dr.nuMe's brand positioning. From scrutinizing program strategies to evaluating market dynamics, this concise document empowers informed decisions for sustained success.

Table of Content

Competitive landscape

- Industry Insights (industry History, Popularity, Reputation, Industry Trajectory, Trend, Number of Players)

- (List of competitors identified in the weight-loss medication industry)

Key Players Overview

- (introduction to the scrutinized competitors mentioned in this document)

Direct Competitor #1

- Introduction

- Overview

- Services Description

SWOT

- Lorem Ipsum is simply dummy text of the printing and typesetting industry.

The reasons to

choose Dr. nuMe

Industry Insights

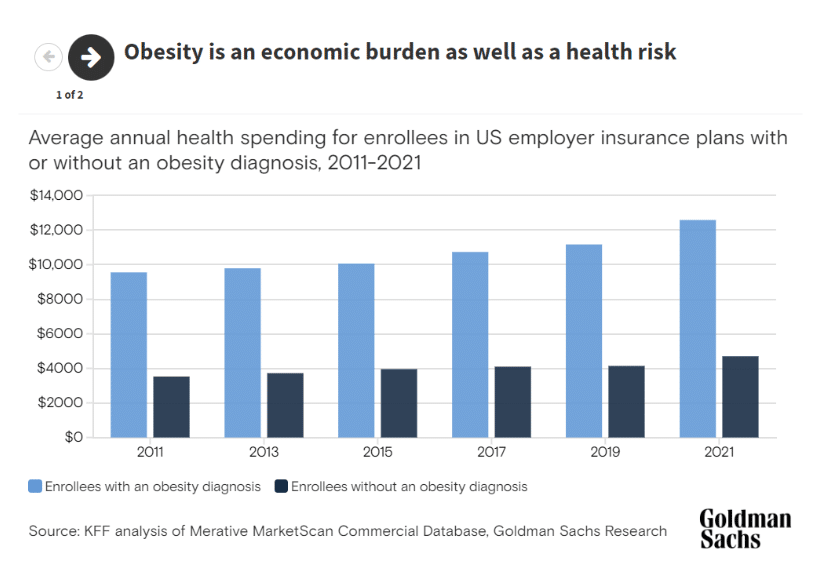

The weight loss medication industry is undergoing a significant transformation, currently valued at $6 billion and projected to reach $100 billion by 2030. Around 13% of overweight/obese adults in the U.S. are expected to be treated with these medications by 2030, while it's anticipated that by 2035, approximately 7% of the total U.S population—around 24 million individuals—will use these drugs. This substantial growth might influence dietary habits and impact the market for less healthy foods.

Regional Growth: North America is experiencing rapid growth in the weight loss drugs market, attributed to the popularity of dietary supplements and weight loss medications.

Reputation: With key players like Eli Lilly, Novo Nordisk, Pfizer, and others actively involved, the industry's reputation is bolstered by ongoing research, clinical trials showcasing substantial weight loss, and acquisitions that reveal growth opportunities and receive a positive adoption on the market.

Industry Trends and Insights

Market segments encompass various types of weight loss drugs such as powder, pills, liquids, injections, and bars, some of which require medical prescriptions while others are available over the counter. Among these medications are options like Orlistat, Phentermine, and various prescription drugs that act as competitors to Dr. nuMe's programs. These drugs serve as potential alternatives for our target audience, offering dietary supplements or over-the-counter solutions for weight loss. Orlistat stands out as one of the most popular prescription drugs for weight loss due to its widespread availability and efficacy in inhibiting fat absorption in the intestines.

Market Segmentation: Overall Obesity Prevalence

The overall obesity prevalence in the U.S. is 41.9%, indicating a substantial market size for weight management solutions.

Health Equity and Demographics:Non-Hispanic Black adults have the highest age-adjusted prevalence of obesity (49.9%), followed by Hispanic adults (45.6%), non-Hispanic White adults (41.4%), and non-Hispanic Asian adults (16.1%). This demographic breakdown is essential for targeted marketing and product development.

Age Groups:Obesity prevalence varies across age groups, with rates of 39.8% among adults aged 20 to 39 years, 44.3% among adults aged 40 to 59 years, and 41.5% among adults aged 60 and older. Understanding age-specific trends helps in tailoring solutions for different life stages.

Industry Trajectory

The weight loss drugs market is on a significant upward trajectory, evidenced by a projected CAGR (Compound Annual Growth Rate) of 45.7% by 2032. Factors like evolving consumer preferences, advancements in drug types (powder, pills, liquids, injections, bars), and expanding distribution channels (pharmacy, supermarkets, online stores) contribute to this trajectory.

Competitors

The weight loss drugs market boasts several prominent players, including Eli Lilly, Novo Nordisk, Pfizer, Takeda Pharmaceutical, VIVUS, Bayer, F Hoffmann-La Roche, GlaxoSmithKline, Arena Pharmaceuticals, and Eisai Co. Ltd., as the main providers of the medication for all of Dr. nuMe´s direct competitors indicating a competitive landscape with multiple established entities actively contributing to market growth and innovation. As direct competitors of Dr. nuMe, standout names include For Hims, Calibrate, Henry Meds, and 18 other important companies like:

- MDEXAM

- VILLAS HEALTH AND WELLNESS

- FOR HIMS

- HENRY MEDS

- LIFEMD

- NEXT MED

- VITASTIR

- JOIN MOCHI

- EQUENCE

- SESAME

- PLUSH CARE

- INVIGOR MEDICAL

- THE WEIGHT LOSS CENTER

- CALIBRATE

- SEMASPACE

- ALAN MEDS

- EVERLY WELL

- JOIN FOUND

- JOIN ALFIE

- QUICK MD

- HEALLY

- RO

- ZEALTHY

- MEDICOLOGY HEALTH

- NOOM

- NU IMAGE MEDICAL

Expected for 2024

More Wins for Lilly and Novo

Eli Lilly & Co. and Novo Nordisk, leading pharmaceutical giants in the obesity-drug race, are expected to continue their dominance. They're developing enhanced versions of their drugs and launching next-generation candidates.

Increased Business Deals

Anticipated rise in mergers and acquisitions within the obesity-drug market. Larger companies are seeking to expand their presence by acquiring smaller firms that have persisted in the industry.

No Magic Pills

Despite interest in pill versions of popular medications like GLP-1, challenges persist due to high rates of side effects. While advancements are expected, doubts linger regarding their preference over injections.

Development of Muscle-Preserving and Side-Effect-Reducing Drugs

Ongoing research aims to offer weight-loss benefits without common side effects. There's also a need for drugs that help preserve muscle during weight loss, an area where companies like Lilly and Roche are actively engaged in.

Enhanced Insurance Coverage, Greater Patient Access

Emphasis on improving insurance coverage to enable more people to access these treatments. While progress has been made, legislative changes, such as inclusion in Medicare coverage, are still required for wider availability.

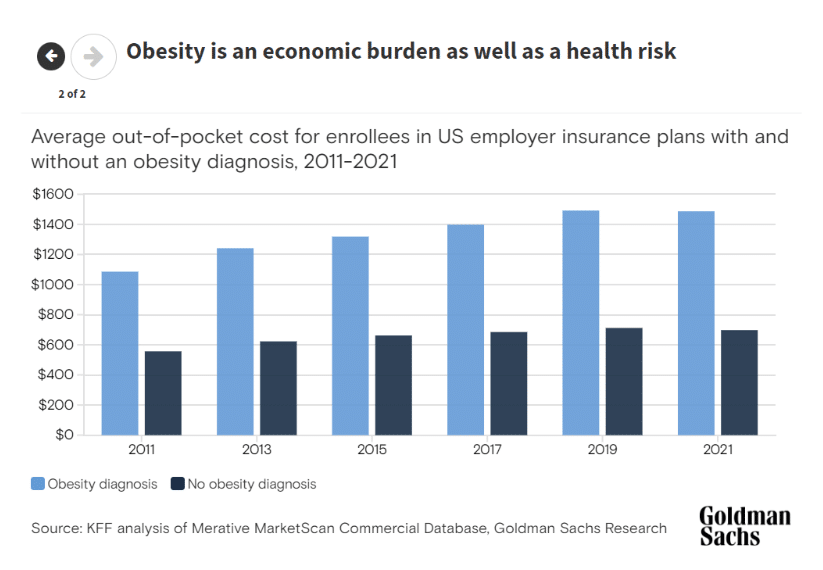

In terms of the importance and impact of insurers in this industry, these play a crucial role. As the acceptance and adoption of weight loss medications increase, insurance coverage for these treatments becomes a determining factor. Insurers play an essential role in influencing the accessibility of these medications for all qualified patients.

Competitors

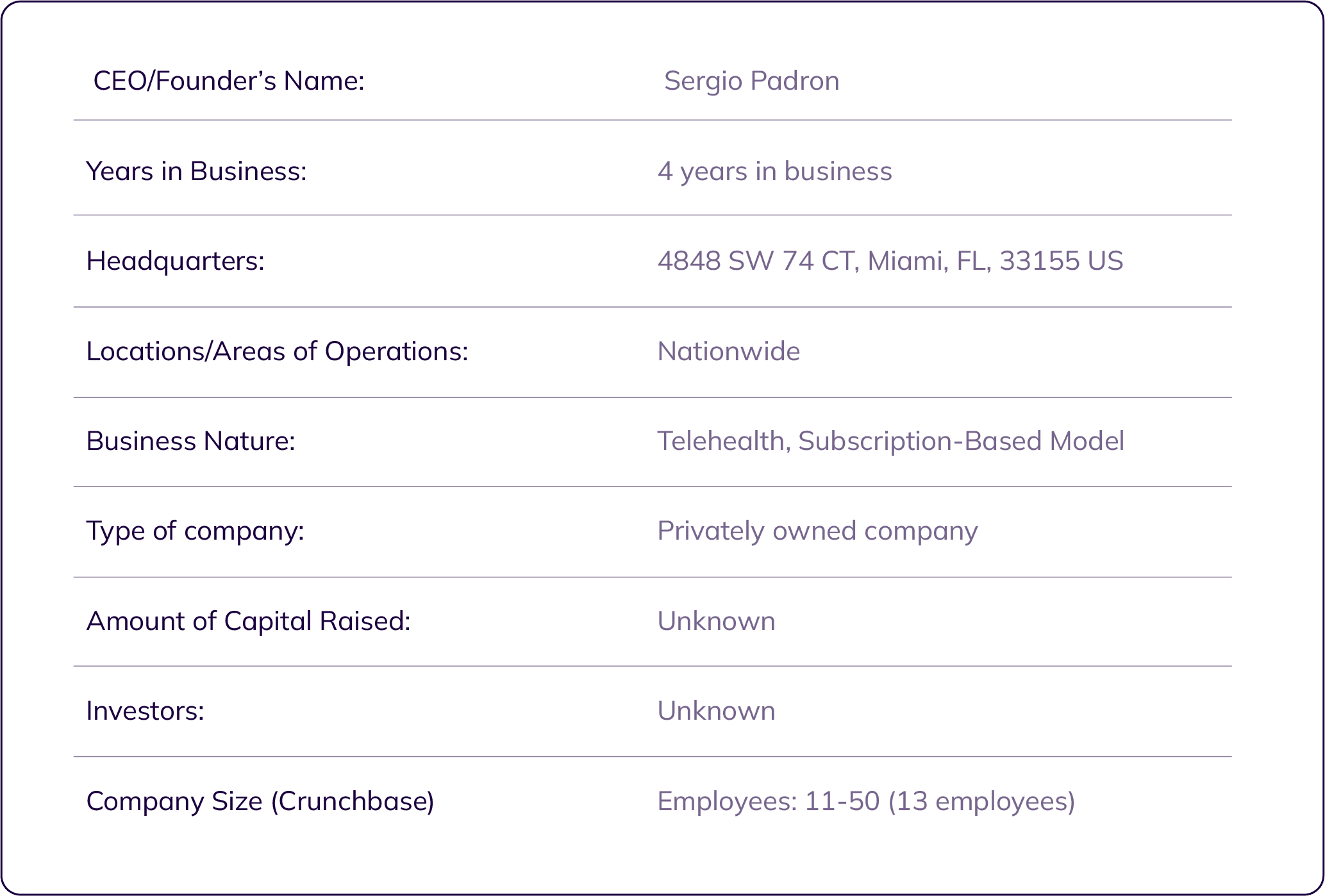

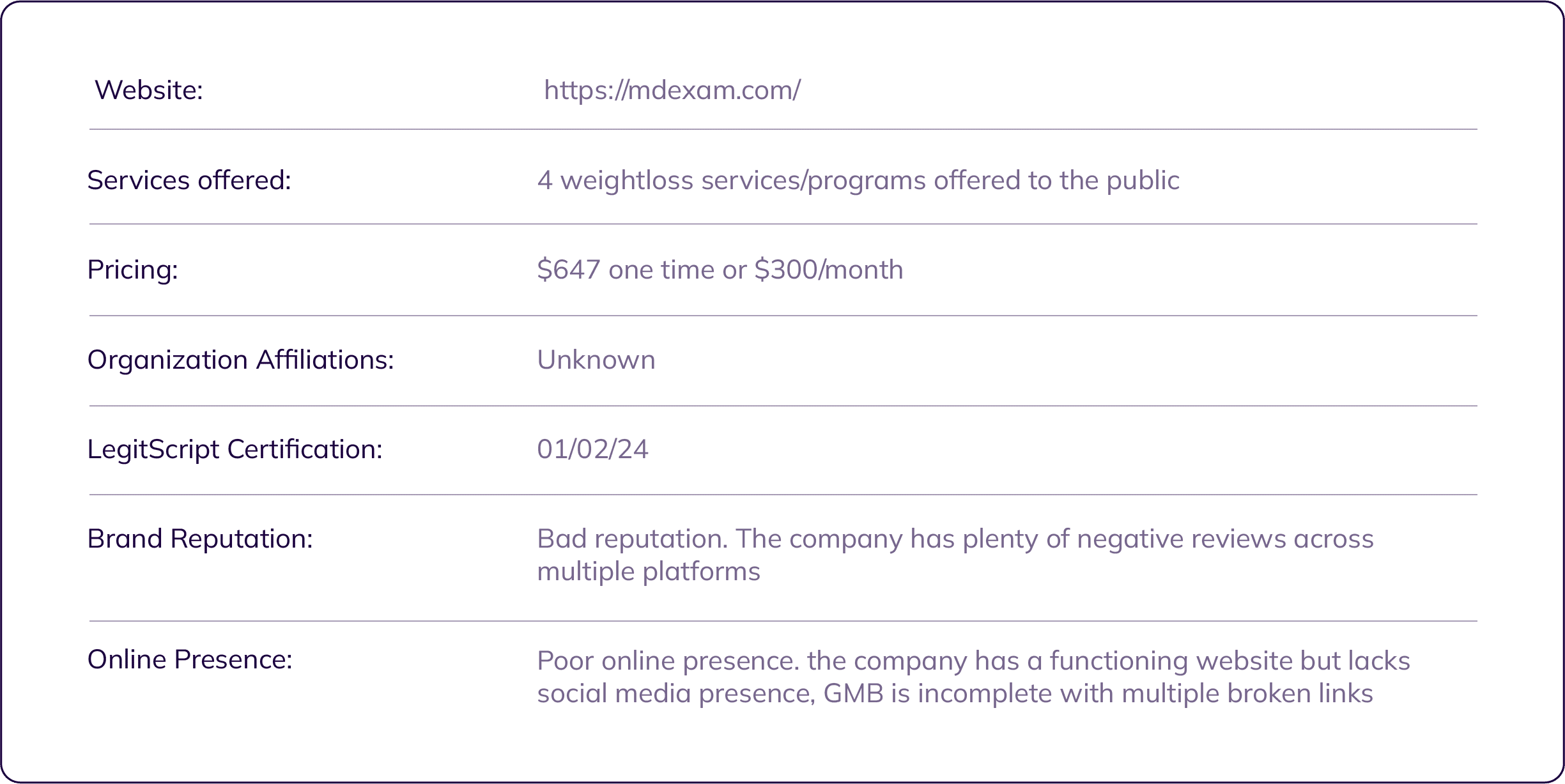

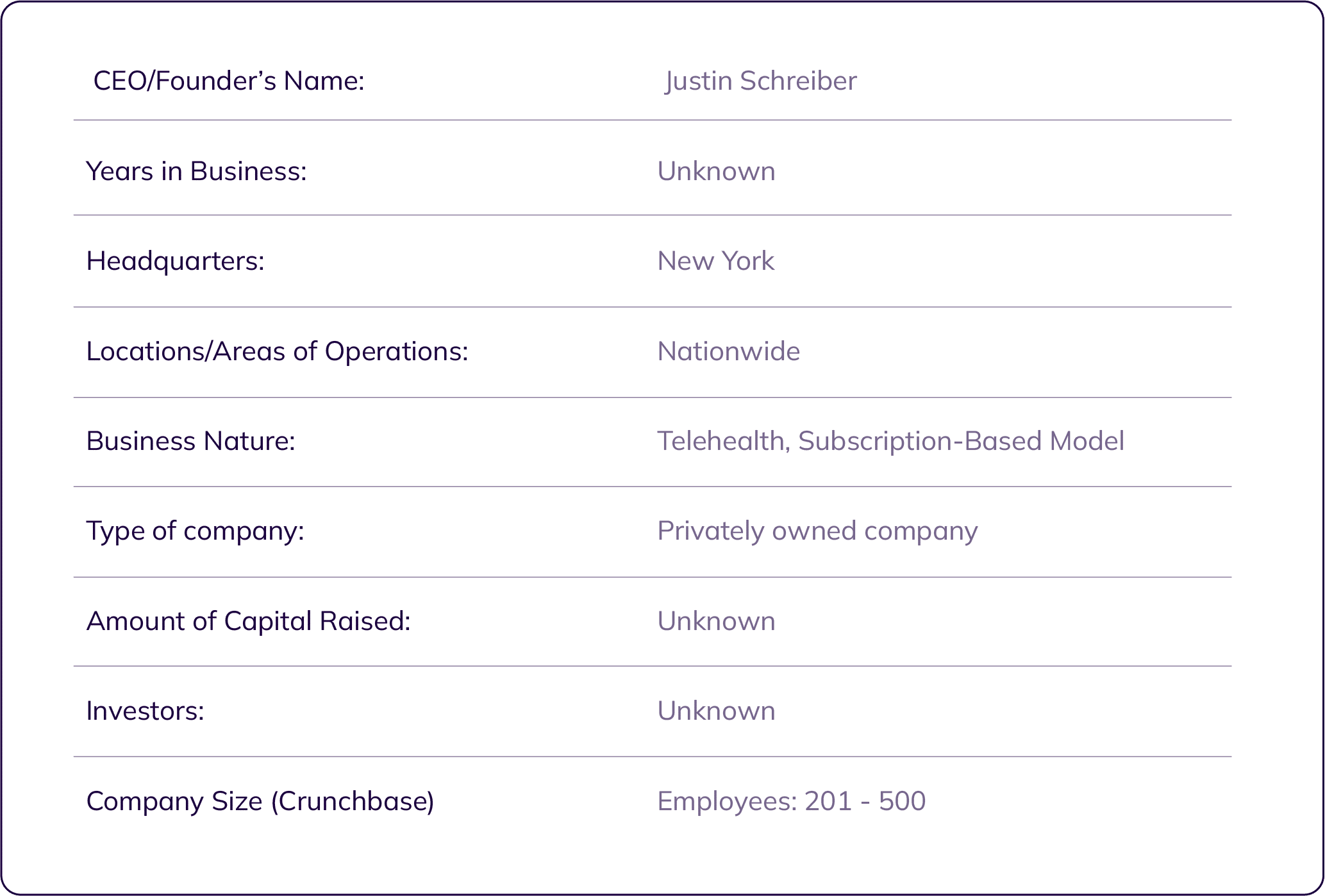

Established in 2019 in Miami, FL, MD Exam is a our first competitor in the market due to its substantial influence, proximity and direct competition with Dr.nuMe.

Despite MD Exam's reputation in the industry, its strategic initiatives and market footprint make it a noteworthy contender. Let's delve into the specifics that position MD Exam as a crucial player in our ongoing analysis.

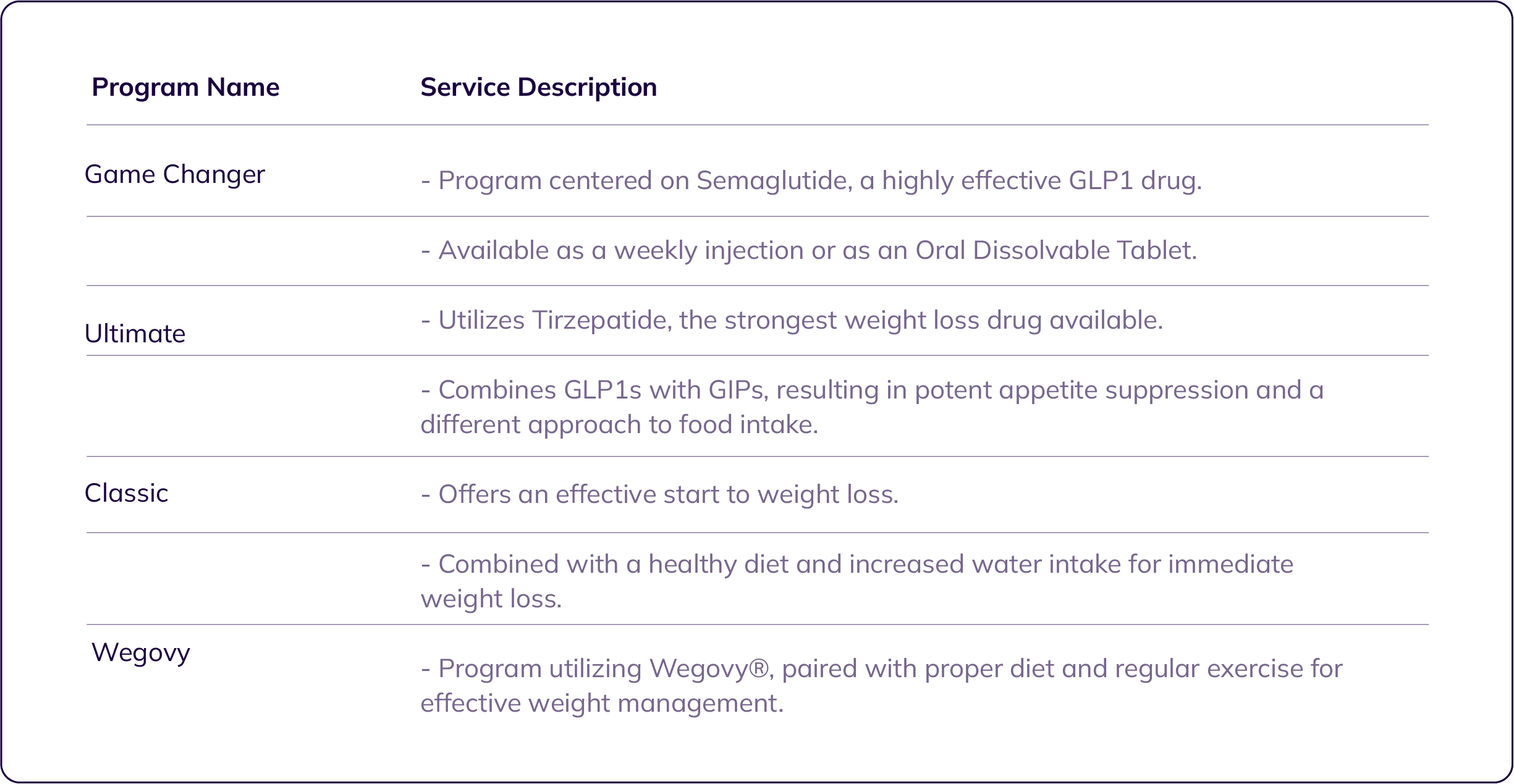

Company Overview

Service Description

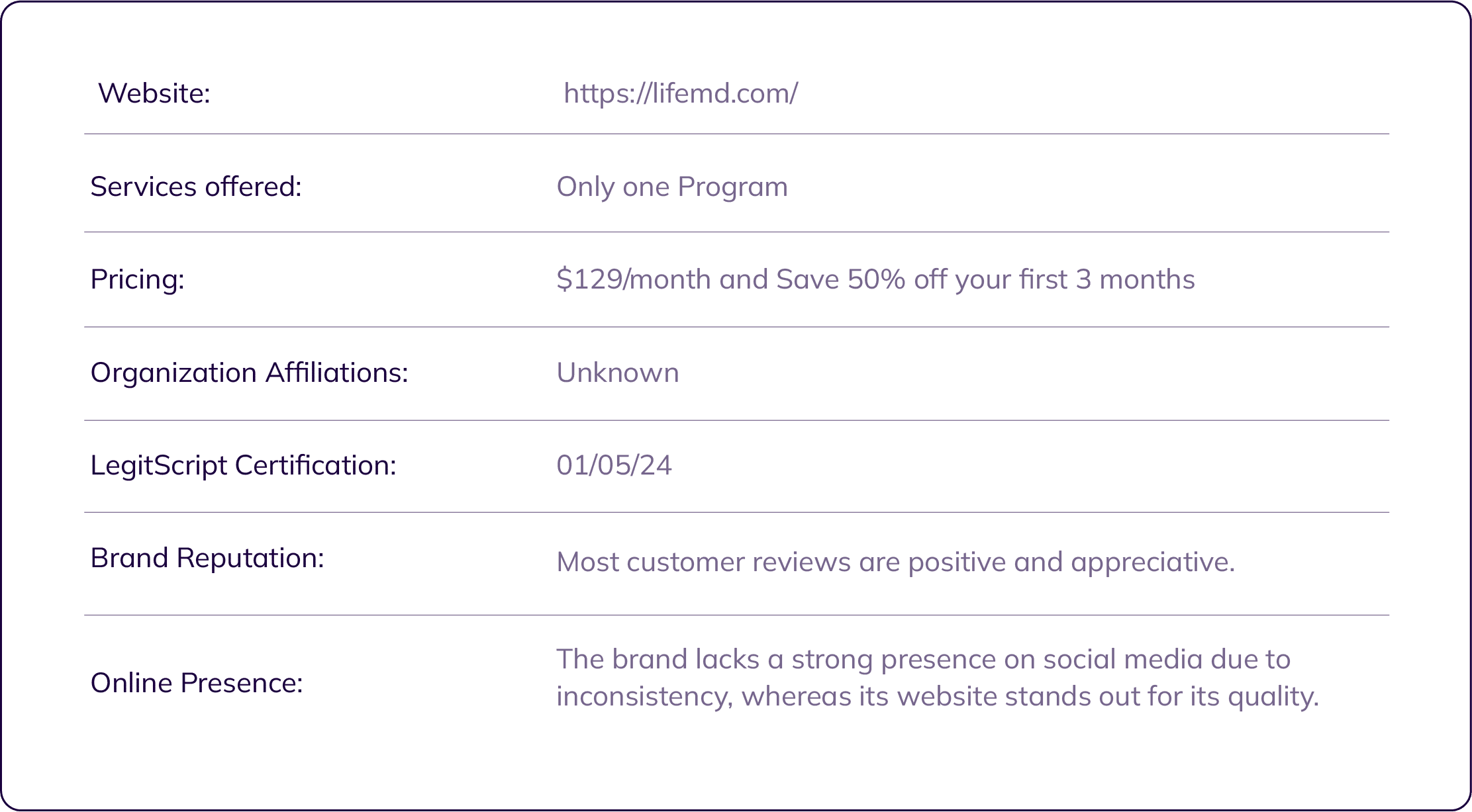

Founded in 2016 in New York, LifeMD has emerged as a significant competitor in the field of weight loss medication, directly challenging Dr. nuMe in the market. Its patient-centered approach and attempt to simplify and personalize healthcare are features that challenge Dr. nuMe's approach in the market.

Company Overview

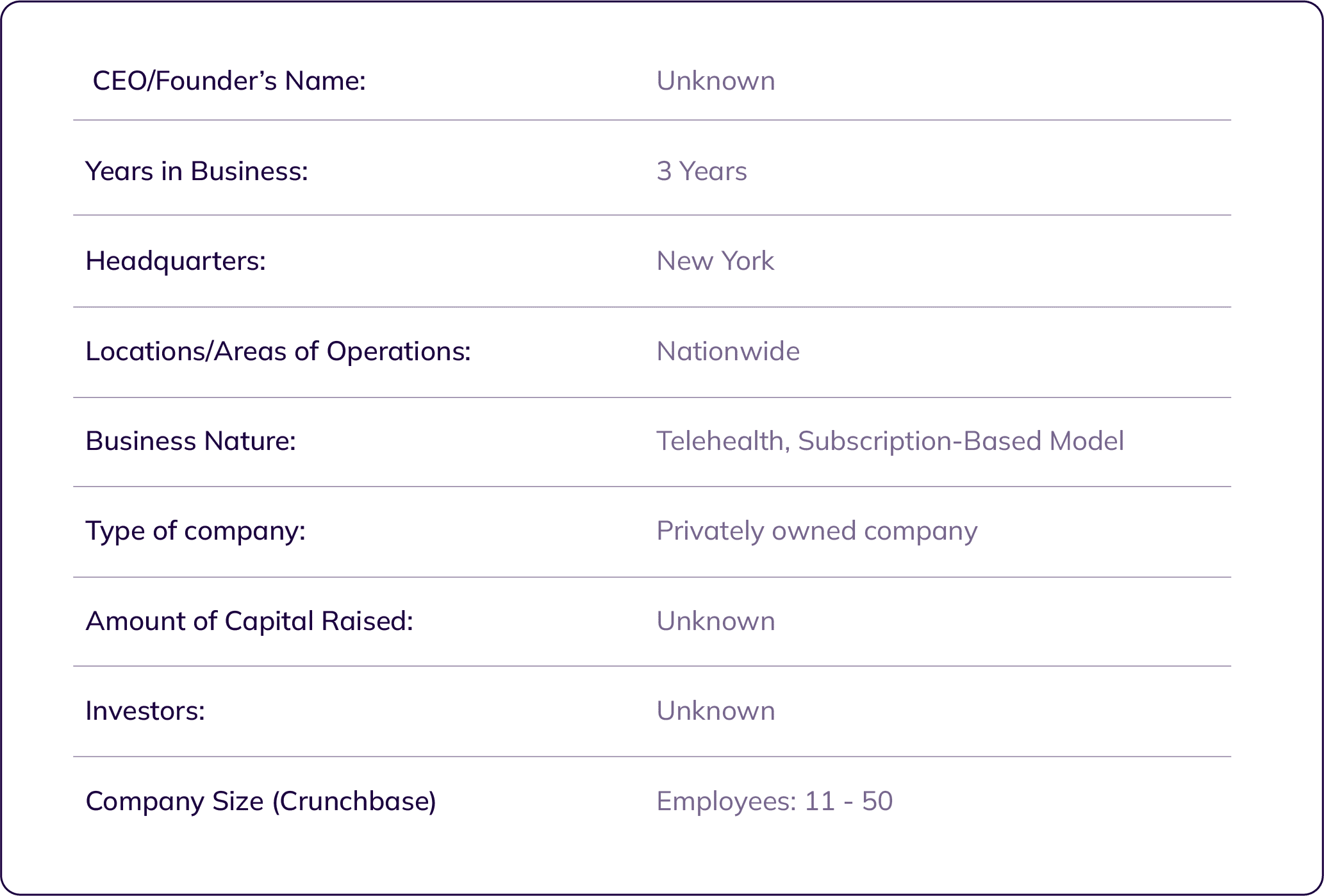

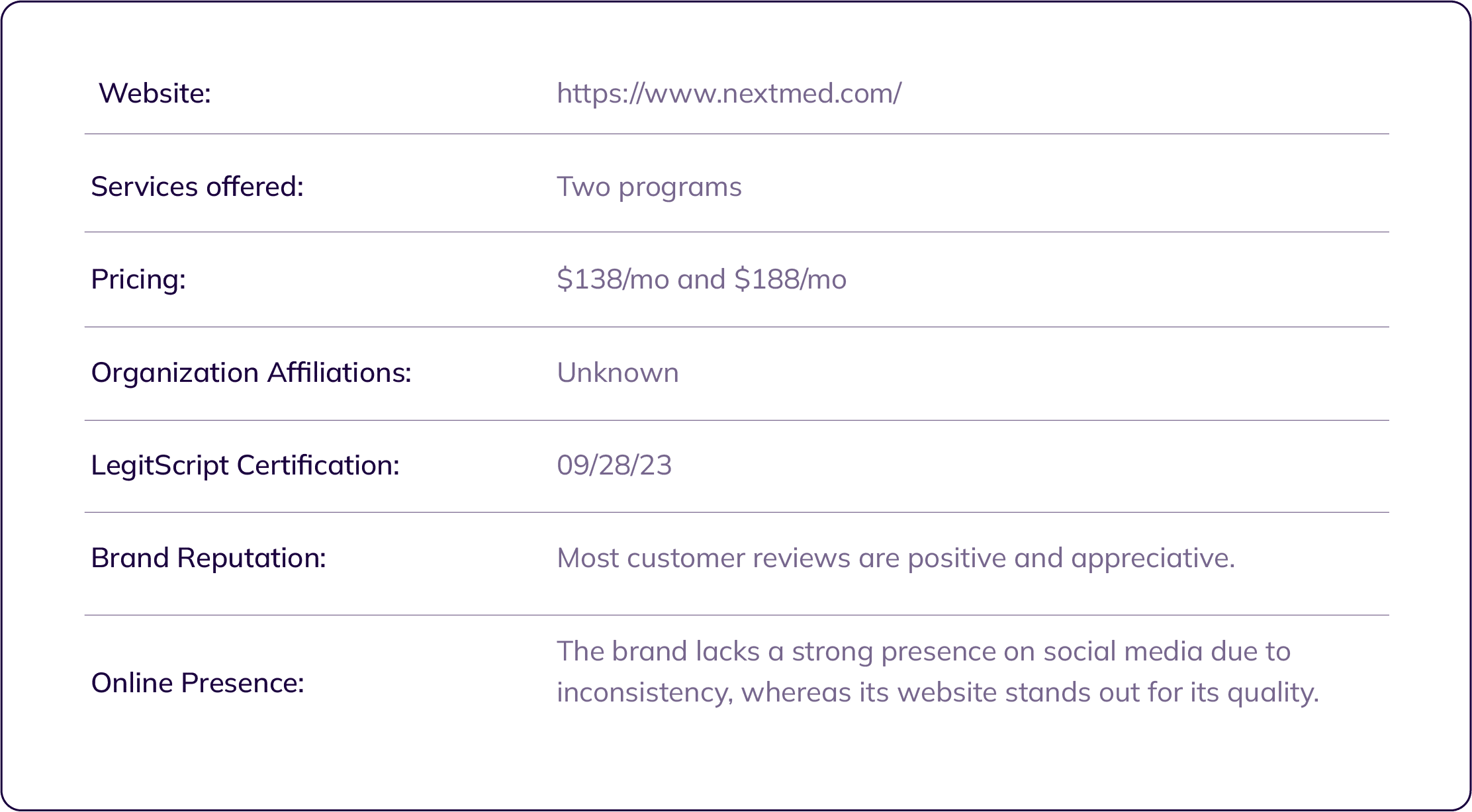

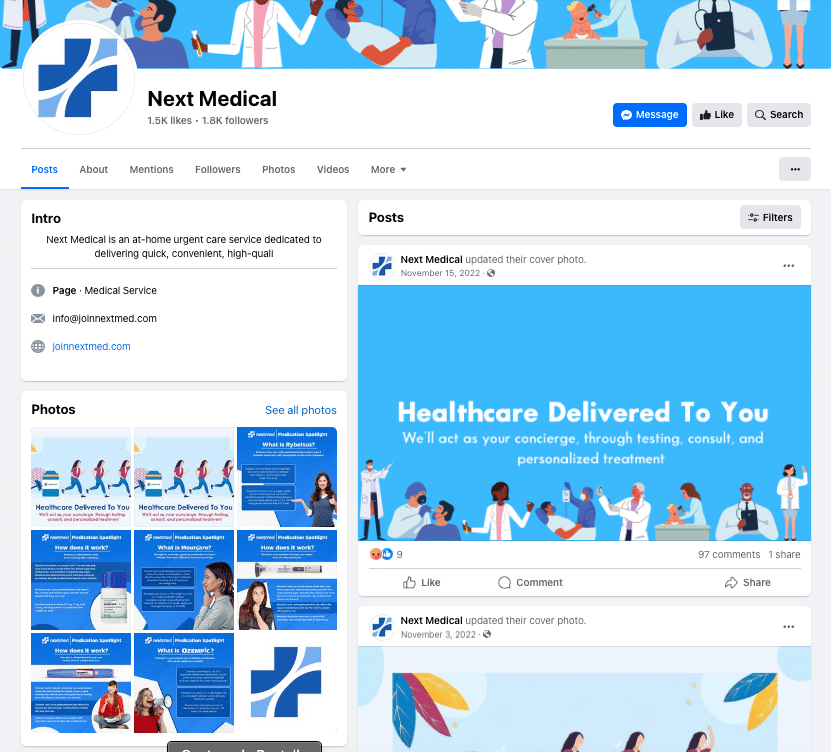

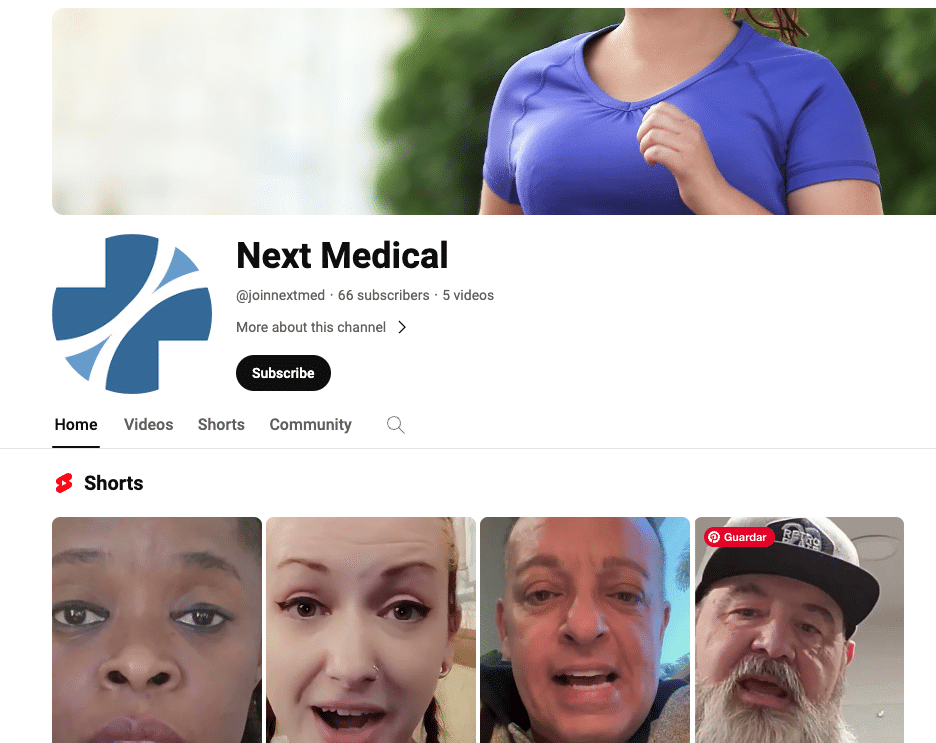

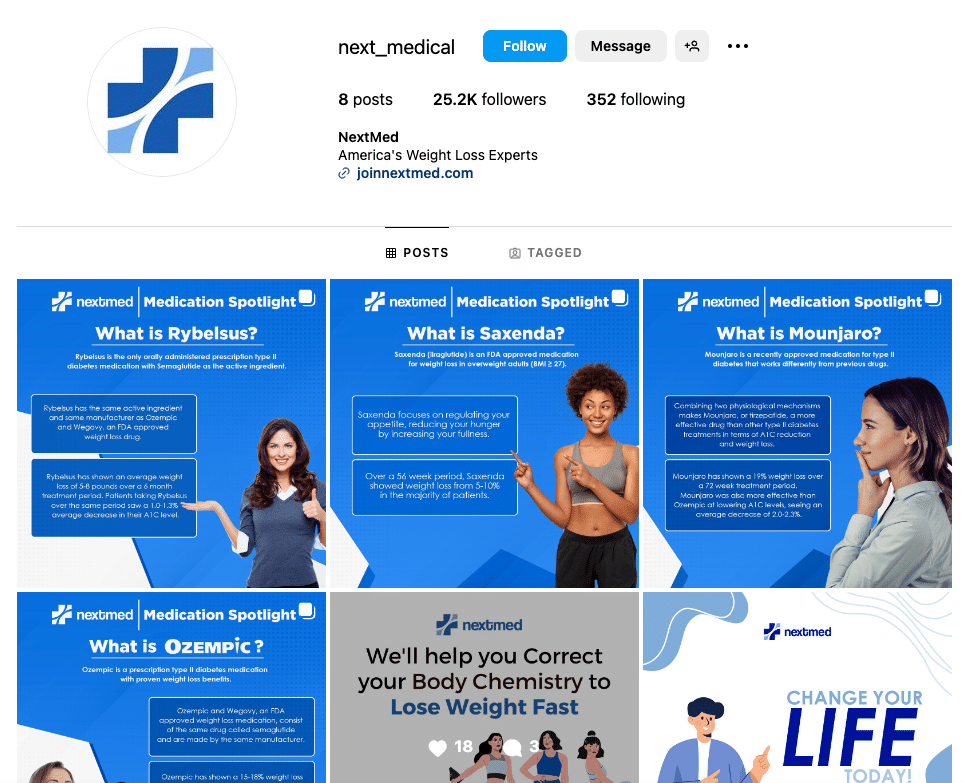

Established in 2021 and headquartered in New York, NextMed stands out by offering a doctor-led weight-loss program that revolutionizes the accessibility and continuity of care. Setting itself apart from other providers, NextMed provides extensive access to medical professionals, ensuring continuous communication and support throughout the weight-loss journey.

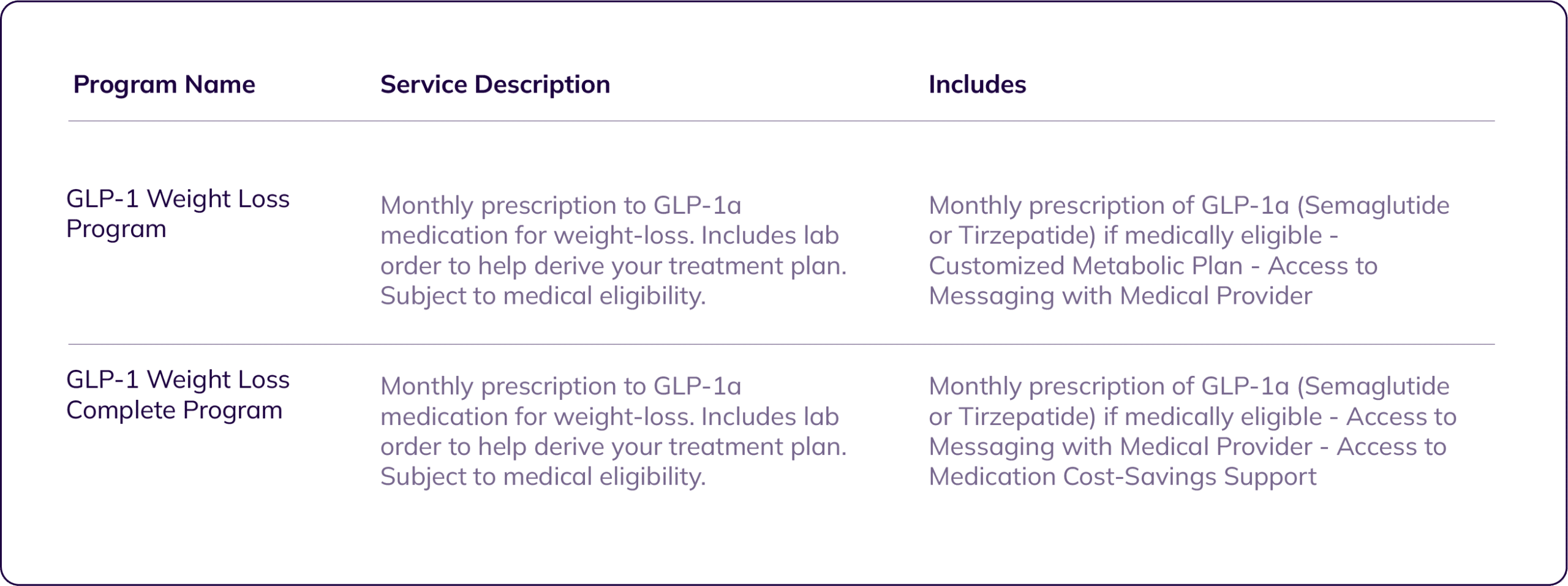

Company Overview

Service Description

Goliaths

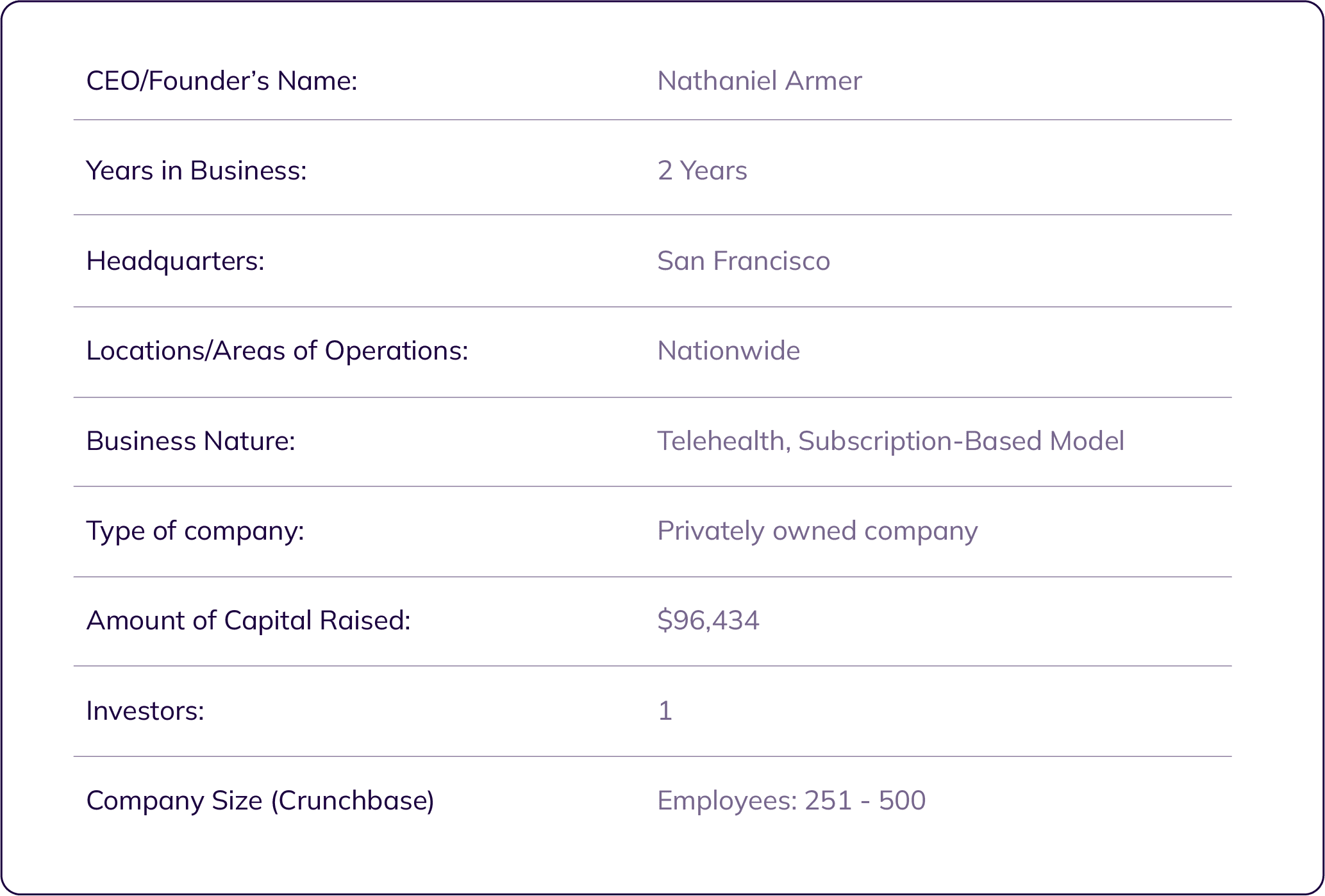

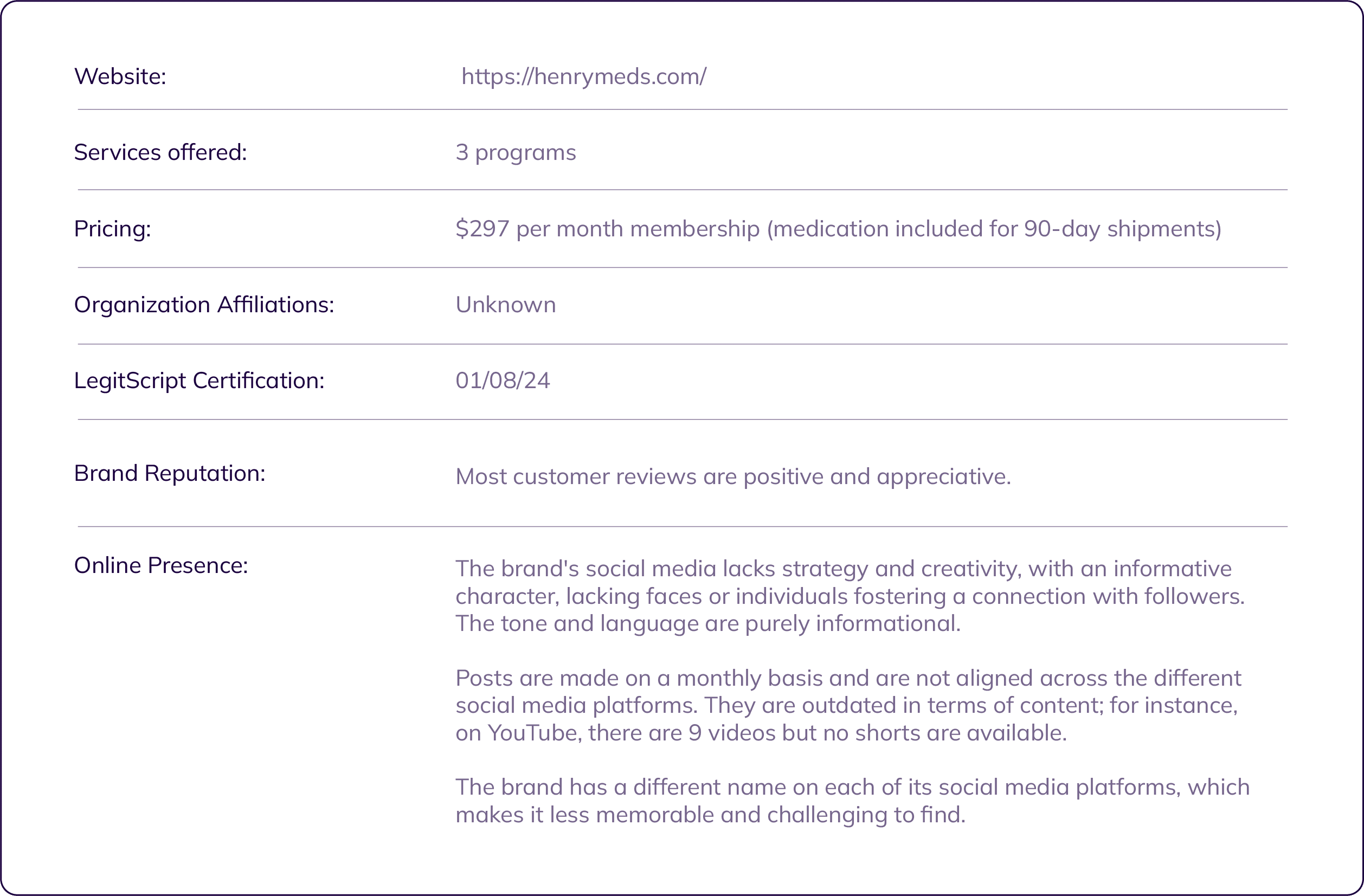

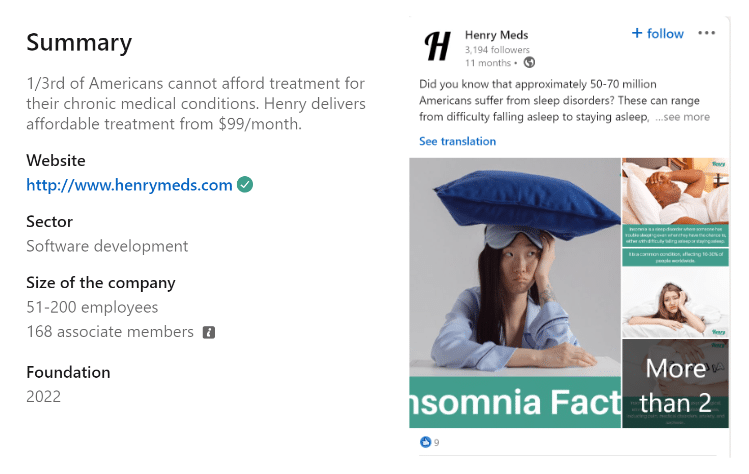

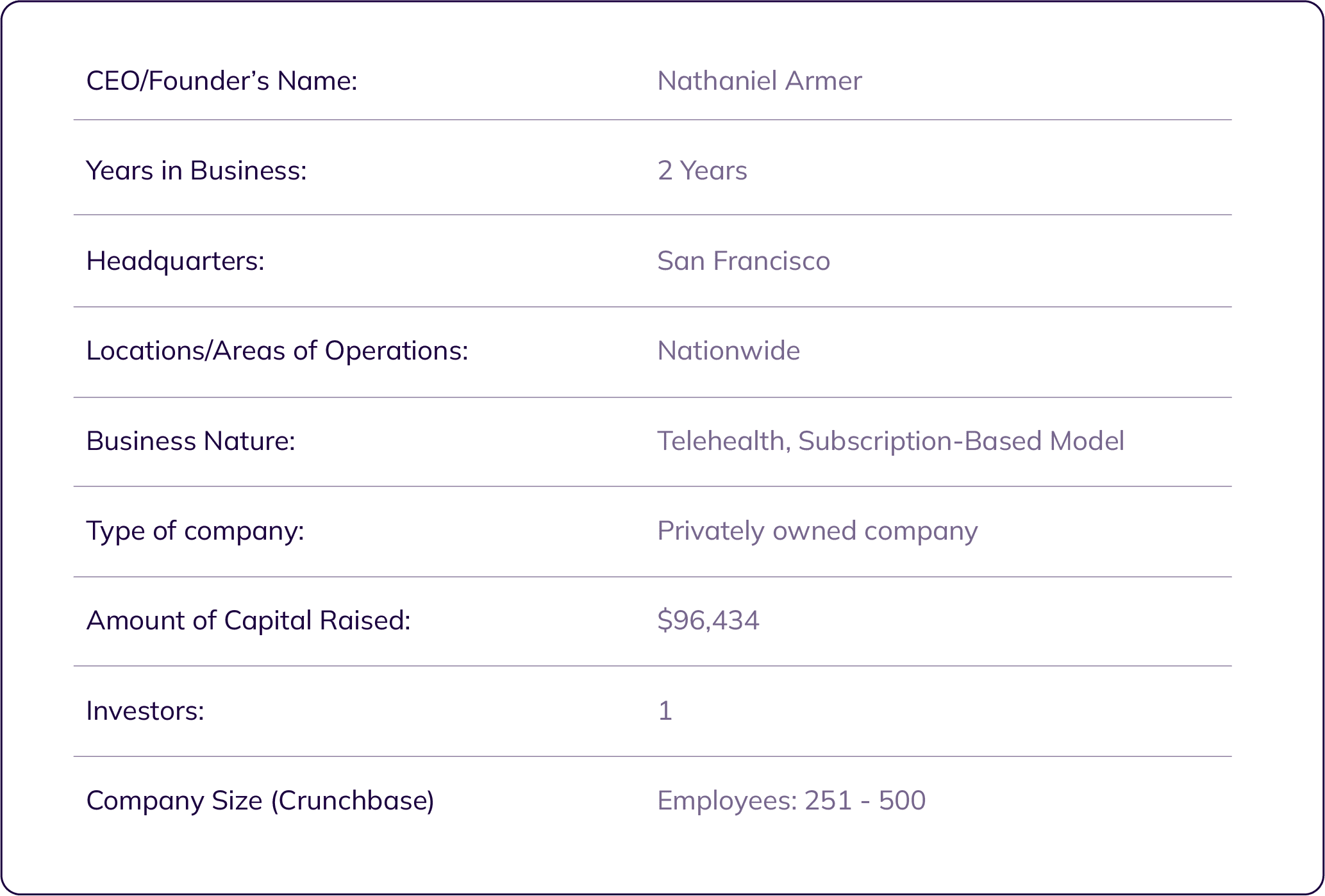

Founded just 2 years ago, in San Francisco Henry has quickly established itself in the industry as a potential competitor for Dr.nuMe. With a capital raise of $96,434, the brand offers 3 distinct programs . However, its online presence presents challenges.

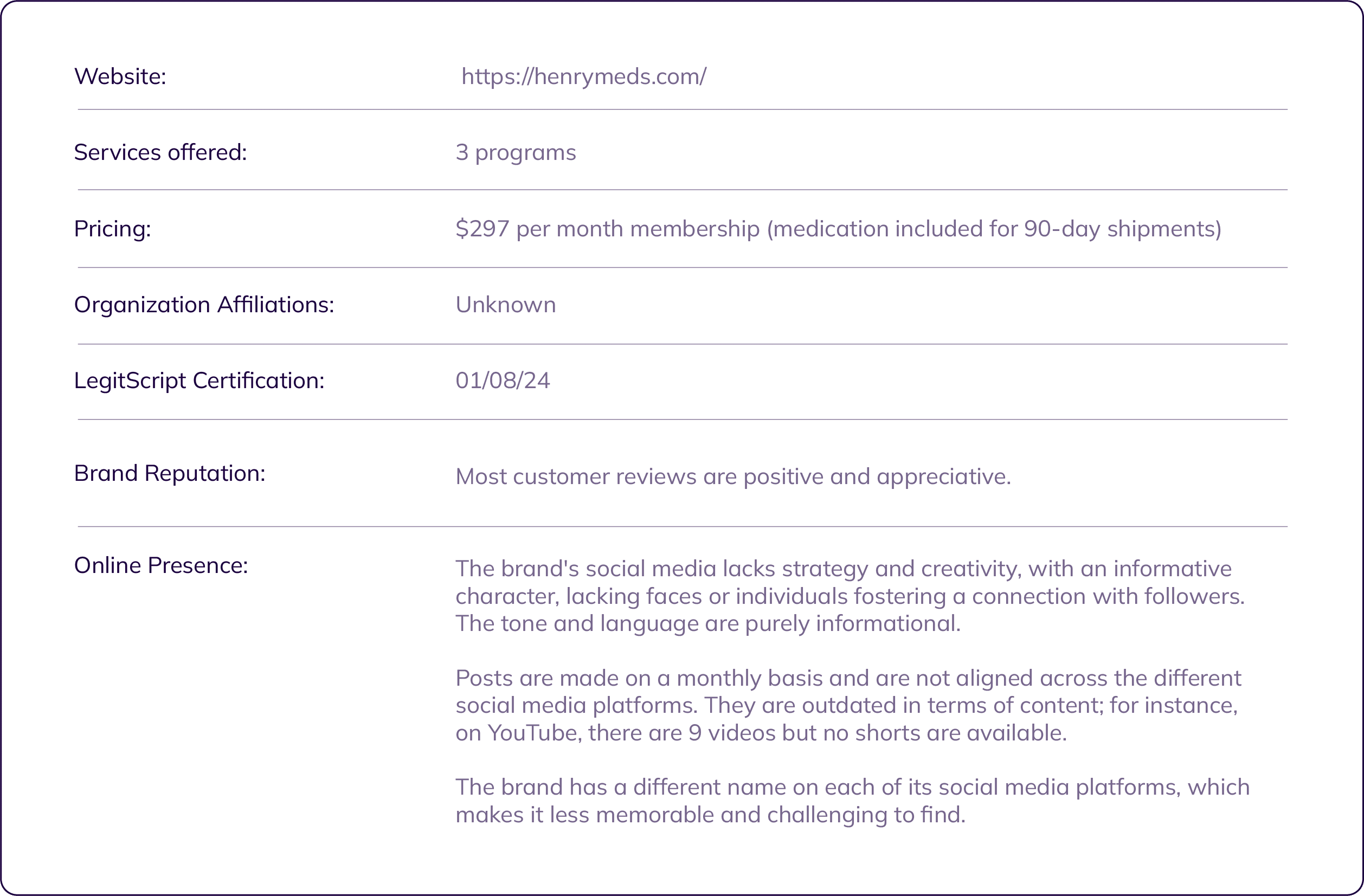

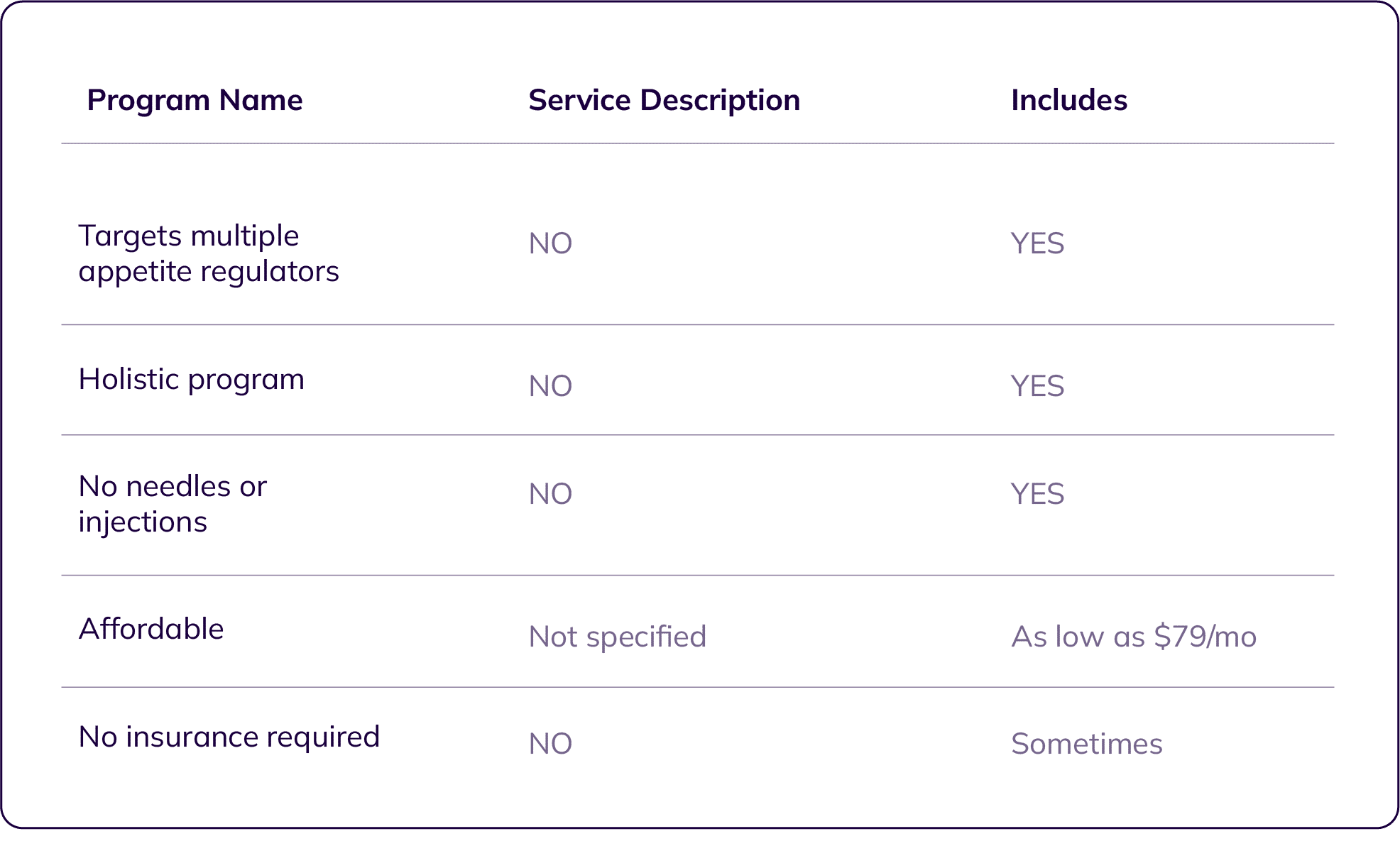

Company Overview

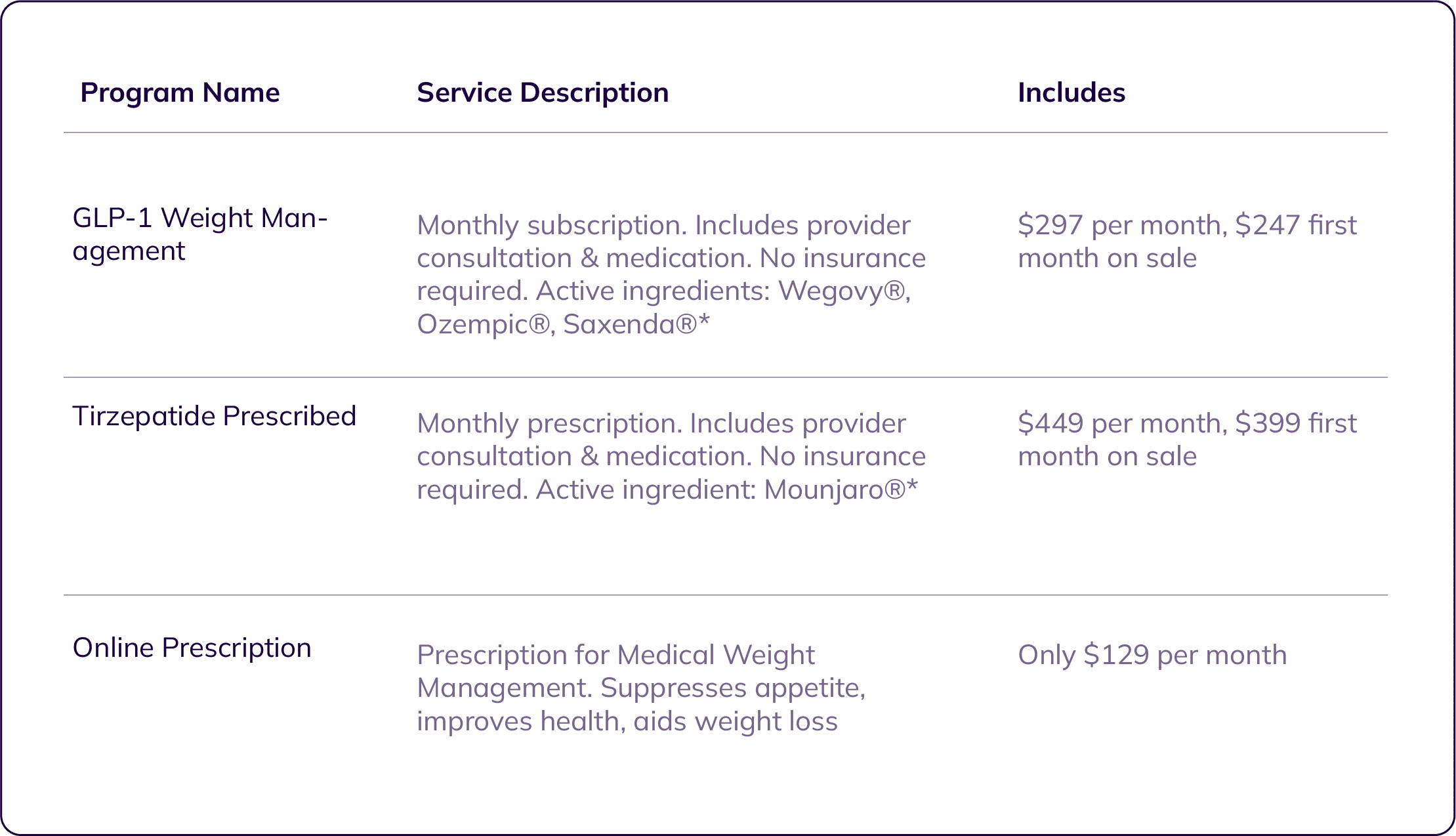

Service Description

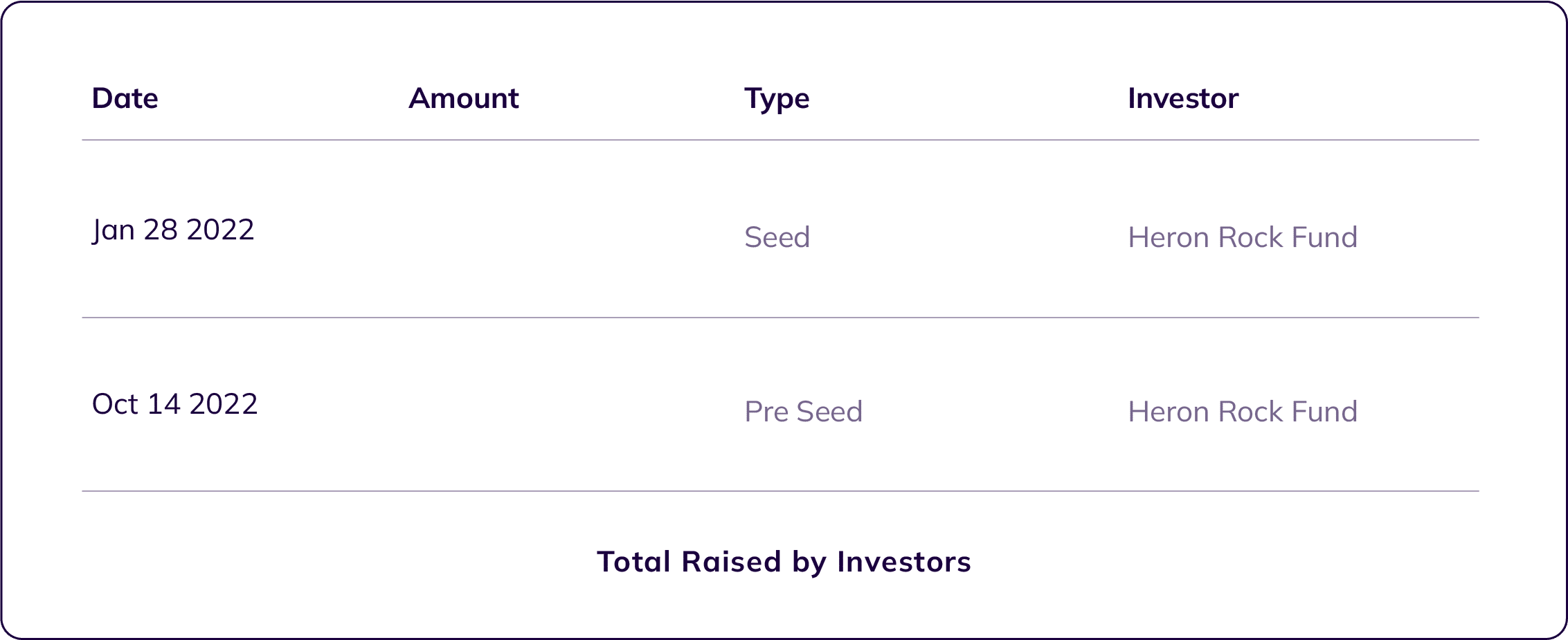

Financial / Investors

Founded just 2 years ago, in San Francisco Henry has quickly established itself in the industry as a potential competitor for Dr.nuMe. With a capital raise of $96,434, the brand offers 3 distinct programs . However, its online presence presents challenges.

Heron Rock Fund made seed and preseed investments in Henry Meds in January and October, respectively with undisclosed amounts.

Data and figures by: Crunchbase.com

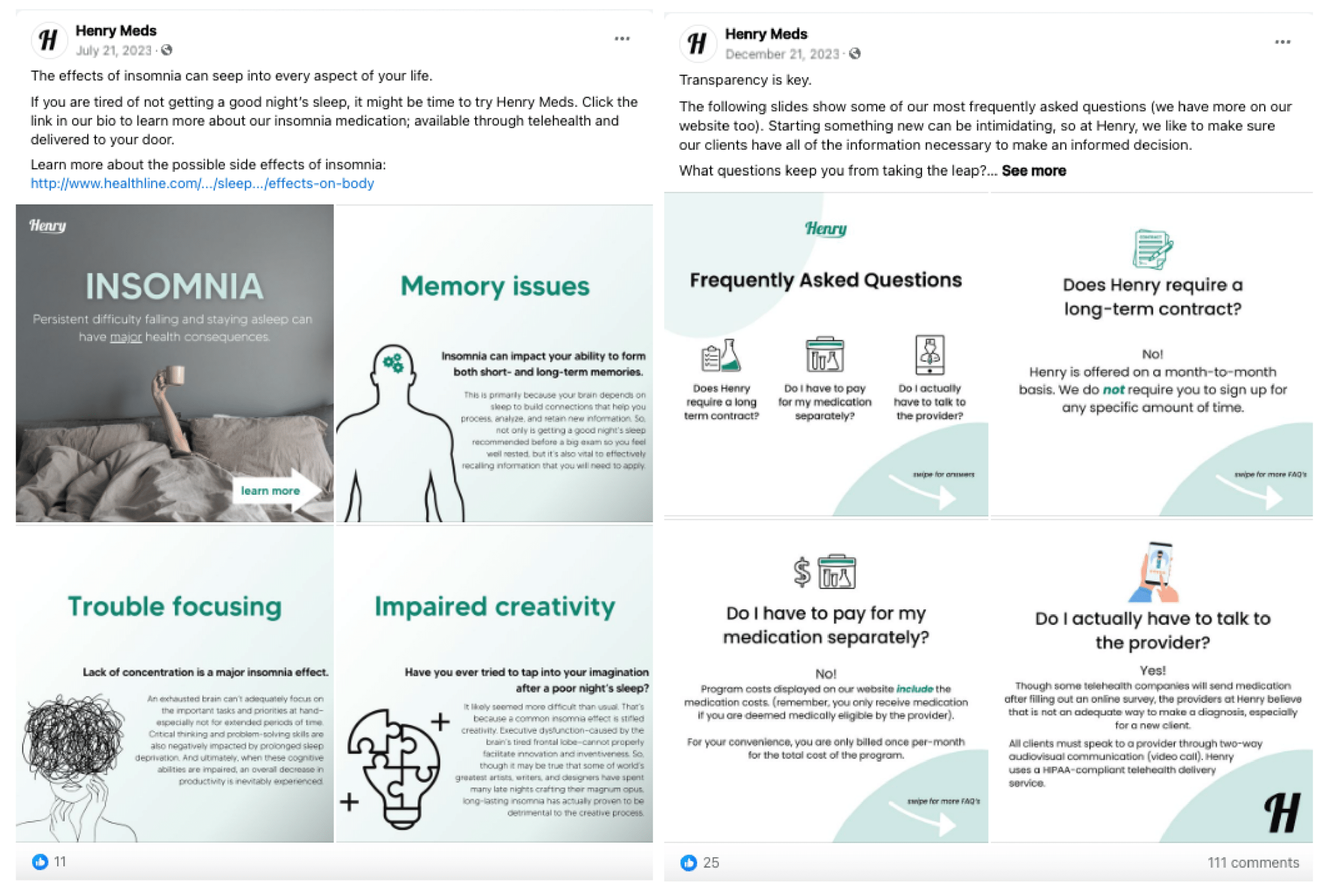

July 21 - December 22

Followers 16K

Last Post Publish: December 20

0 active paid campaigns

In the last month, Henry Med has experienced significant growth in its Facebook presence, adding 1,000 new followers and reaching a total of 16,000. The page has 14,000 "likes." The page information, including location, links, and contact, is fully up-to-date. Additionally, Henry Med maintains a consistent presence on the platform, regularly posting content, either daily or every other day.

Although posts generate between 10 and 15 likes, the continuous growth in the follower base suggests sustained interest in Henry Med's content on Facebook. However, it is important to note that they have not implemented active campaigns on the platform so far.

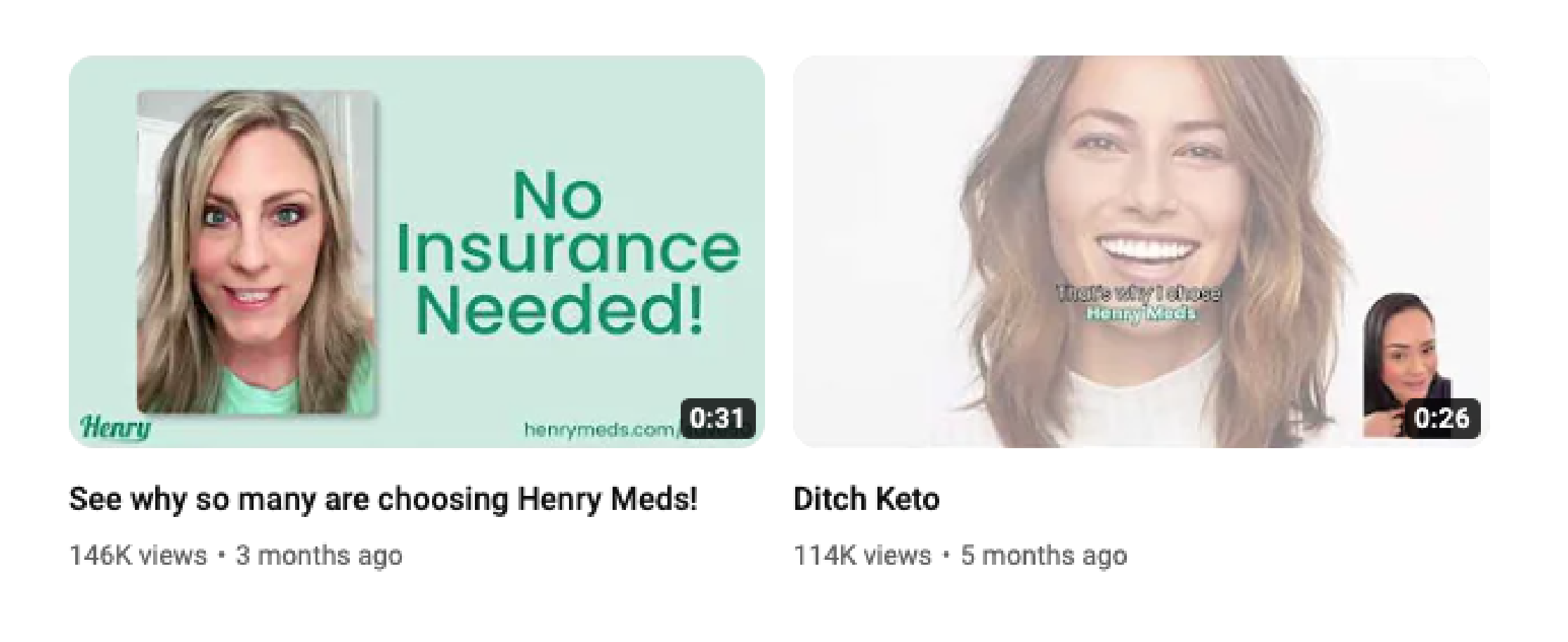

September 28 - December 1

Subscribers 309

Only 9 videos, no shorts

The presence on YouTube stands out with 309 subscribers and 9 available videos. It's noteworthy that they have not ventured into the short video format yet. Video posts are consistent, with the latest video uploaded in early December, following the most-viewed video released on September 28, which focuses on the keto diet and has amassed 114,000 views. The most recent video, from December 1, has garnered 15,000 views.

July 17 - December 21

Followers 2394

Following 4

Post: 48

On Instagram, they have 2,373 followers and have made 49 posts. The posting frequency varies between 2 and 5 business days. In the last 6 months, the maximum number of likes on a post was 27, while the average ranges between 6 and 8 likes per post. In most posts, there are no comments observed. The content is characterized as informative.

February

Followers 3K

Post Frequency: Low (Monthly)

On Instagram, they have 2,373 followers and have made 49 posts. The posting frequency varies between 2 and 5 business days. In the last 6 months, the maximum number of likes on a post was 27, while the average ranges between 6 and 8 likes per post. In most posts, there are no comments observed. The content is characterized as informative.

Press

When conducting a search, no articles were found, indicating a weak online presence. The search results mainly consisted of cautions regarding the unregulated use of OZEMPIC and injections for weight loss.

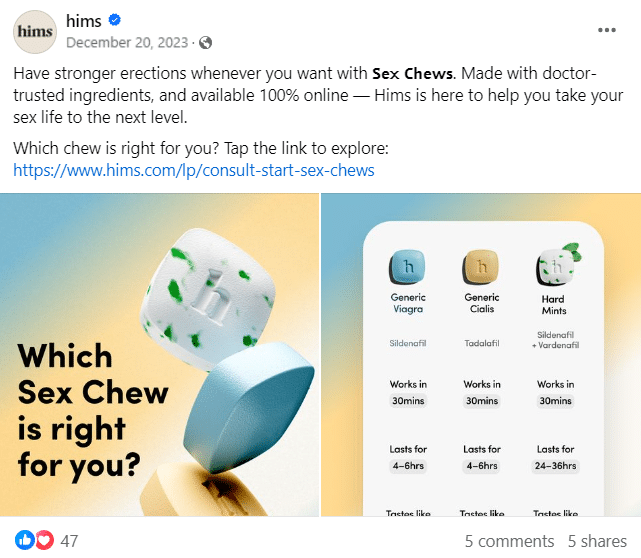

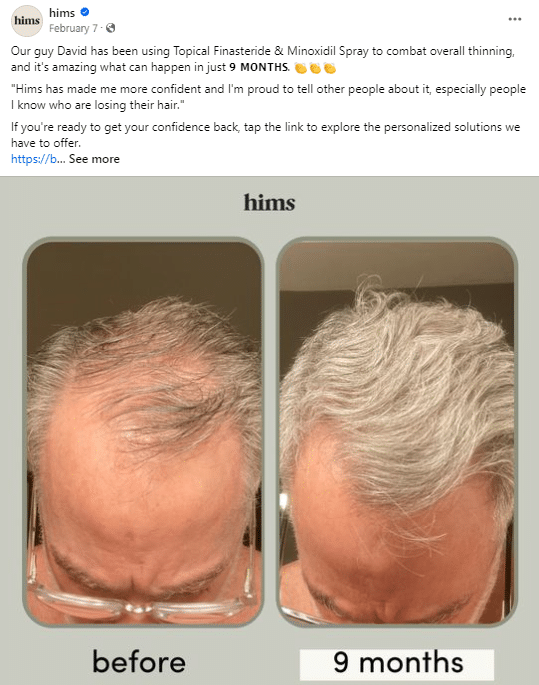

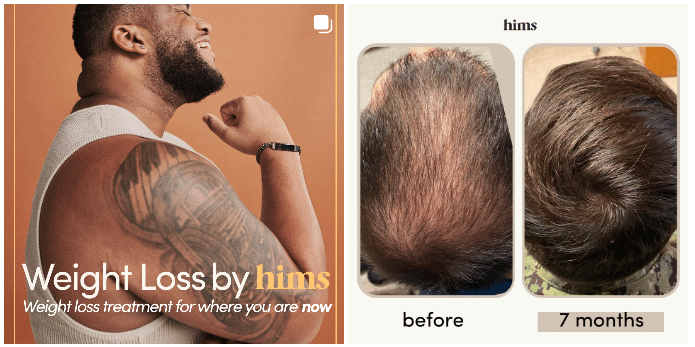

Hims, with 6 years in the industry, offers a range of weight loss programs with different types of medications such as Metformin, Topiramate,Naltrexone and Bupropion based on studies of this medications regarding to weight loss. Even Though hims is licensed in all 50 states, for weight loss is not current available in FL.

Company Overview

Service Description

It lacks a description of its Semaglutide program, opting instead to compare its holistic method against the GLP-1 approach.

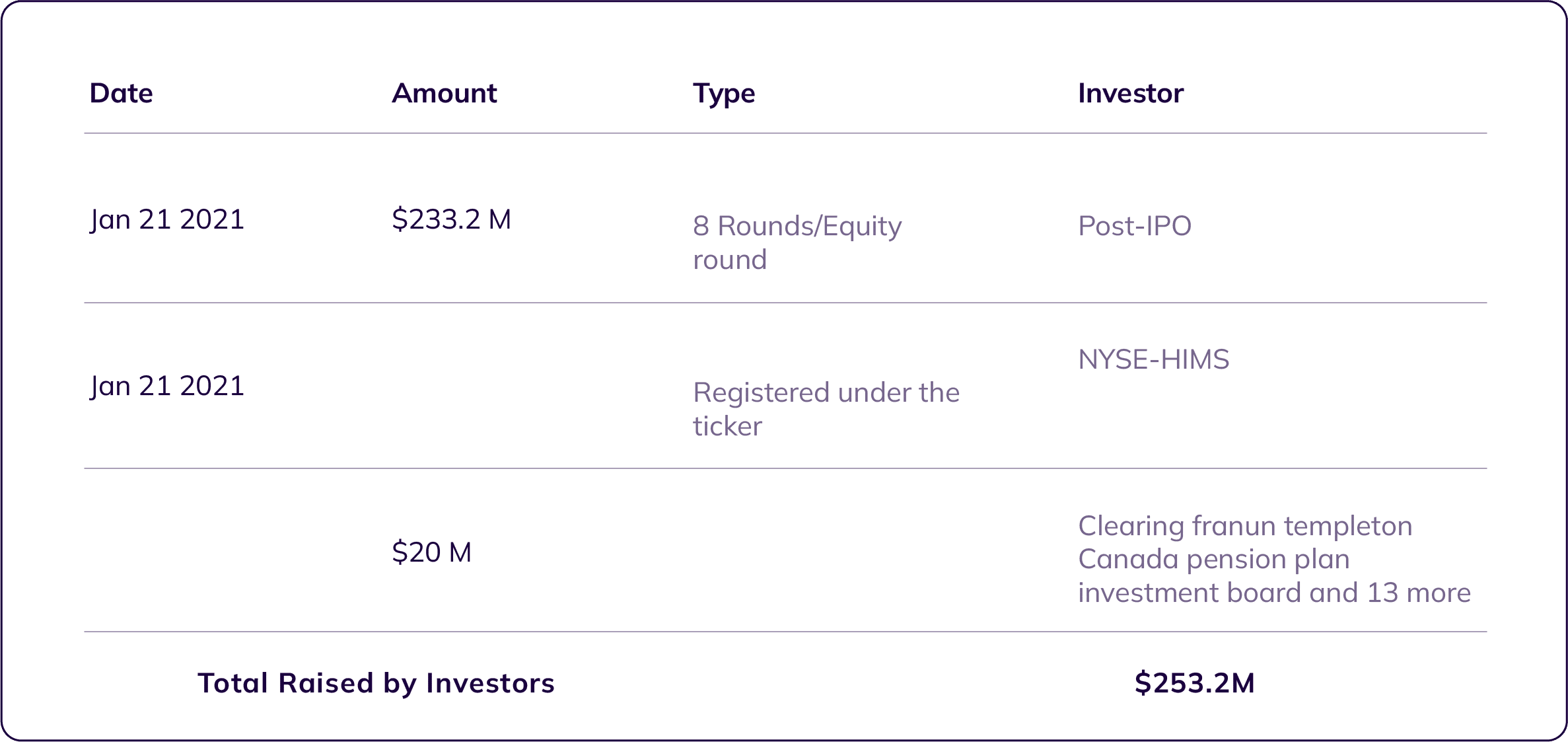

Financial / Investors

The collective funding from multiple transactions amounted to $127.6M, reflecting HIMS' substantial financial growth, leveraging diverse funding strategies across various rounds.

Registered under the NYSE-HIMS ticker in January 2021:

HIMS was listed on the stock exchange (NYSE) under the symbol "HIMS" in January 2021, following the Initial Public Offering (IPO).

$20 million raised from diverse investors:

On an unspecified date, HIMS raised an additional $20 million. Investors included entities like Clearin, Franklin Templeton, Canada Pension Plan Investment Board, and 13 other investors.

Fundraising in January 2021 by HIMS:

HIMS managed to raise an impressive $233.2 million in 8 rounds of funding, with the primary investor being Post-IPO.

December 25

Followers 90K

Last Post Publish: December 25

490 active paid campaigns

HIMS has a robust community with 90 thousand followers and 79 thousand likes. The information on their page is up-to-date, and their language is highly understandable and contagious while maintaining an informative tone. Their strategy stands out by incorporating everyday situations into their posts, creating a stronger bond with customers and fostering identification. Despite having few likes relative to their community (between 5 and 12 per post), the average of 2 to 5 shares per post suggests that their audience feels close and connected to the content. The strategy of linking their products to everyday life situations makes them appealing.

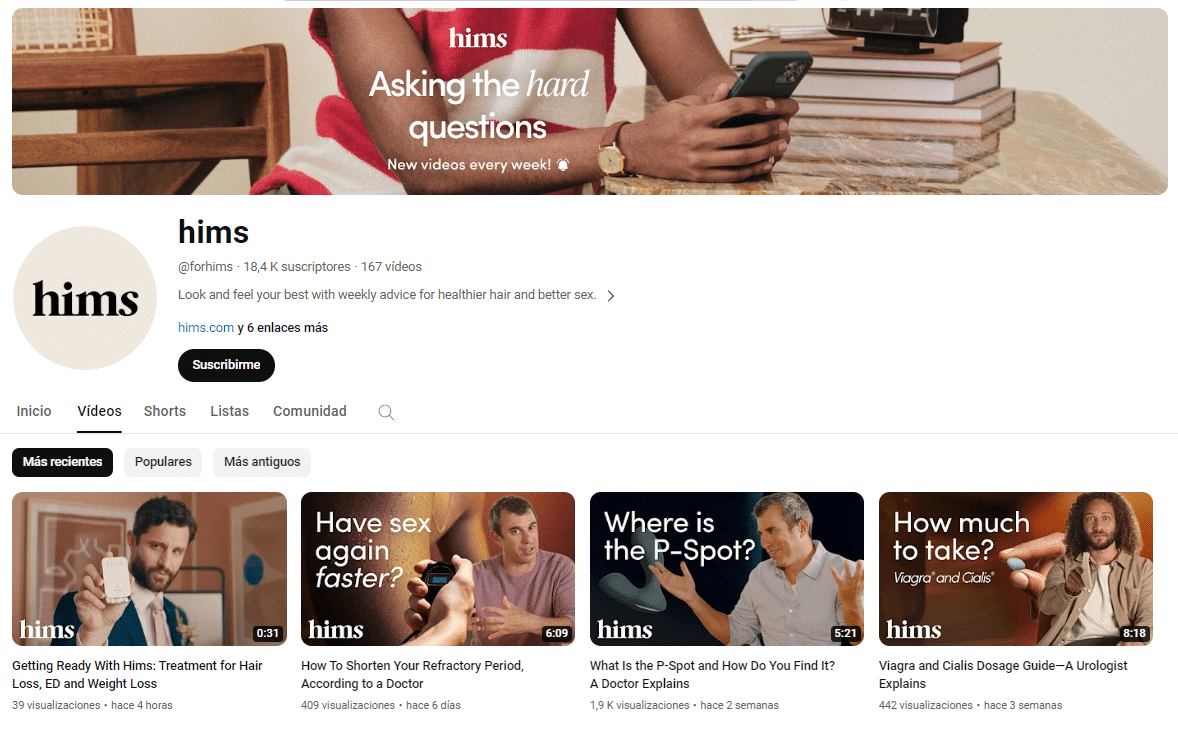

September 28 - December 1

Subscribers 17,8K

30 + Videos and shorts

On YouTube, HIMS has a substantial community with 17.8K subscribers, and their view counts align well with the size of their subscriber base, ranging from 2,000 to 14,000 views. The majority of their videos feature real individuals discussing everyday topics, providing a blend of informative and commercial content. Their posting frequency is consistent for both regular and short-form videos. A notable strength is their well-organized video categorization based on topics of interest, such as playlists covering anxiety, hair loss, etc. This organizational approach serves as a powerful call to action by effectively addressing the concerns and inquiries of potential prospects.

Followers 176K

Following 501

Post: 2.107

Communication with the HIMS audience is close and engaging. They share informative posts, humorous content, and, most importantly, offer distinct content compared to other social media platforms. They have a clear understanding of how to express themselves uniquely on each platform.

On Instagram, posts with humorous content receive the most likes, leveraging humor related to everyday experiences. This aligns with their strategy of connecting with the audience through relatable and entertaining content.

Followers 81.554

Post Frequency: Good (Weekly)

Communication on LinkedIn is more formal, with a focus on informative, economic, and financial content. The company has a substantial number of subscribers, likely including employees and followers who view HIMS as a reference. The information shared is comprehensive and regularly updated, presenting a professional image on the platform. The absence of humorous content aligns with the more serious and business-oriented tone characteristic of LinkedIn.

Press

Regarding Hims & Hers Health Inc., the articles provide information on different aspects of the company's operations and initiatives. They highlight significant stock sales by executives, challenges faced by the company, and varied ratings from analysts. In contrast, the latest press focuses on Hims & Hers introducing a new weight loss program that emphasizes generic medications instead of pricier injectables. This program, scheduled for a full launch in January, includes educational content, personalized profiles, and telemedicine for comfortable discussions on weight-related concerns. CEO Andrew Dudum acknowledges the growing consumer interest in weight loss and the company's cautious approach to integrating certain medications into the program.

Hims & Hers Health, Inc. (NYSE: HIMS) witnessed unusual options trading activity, with a notable increase in put options. Traders bought 10,995 put options, marking a 346% surge compared to the average volume of 2,465 put options. Additionally, CFO Oluyemi Okupe sold 6,794 shares, amounting to $42,666.32, while Director Lynne Chou O'keefe sold 10,045 shares, totaling $63,383.95. The company has faced challenges, including user complaints and shortages of GLP-1 drugs. Insiders have sold 104,098 shares valued at $785,410 over the last three months. Large investors have made changes to their positions in the stock, and analysts have provided varied ratings, with an average price target of $12.08. Hims & Hers Health is trading at $8.79, with a market capitalization of $1.86 billion. The company's recent earnings report showed a loss per share of ($0.04) for the quarter, with revenue of $226.70 million. Analysts forecast Hims & Hers Health to post -0.13 EPS for the current year. The company operates a telehealth platform offering health and wellness products and services.

Hims & Hers is introducing a new weight loss program that emphasizes generic medications like Bupropion, Metformin, Naltrexone, and Topiramate with Vitamin B12, instead of pricier injectables. Set to be fully launched by January, the program includes educational content and tracking features for sleep, hydration, and movement. Users begin with a questionnaire analyzing their eating habits, receiving personalized content from psychologists based on their profiles. Dr. Craig Primack, the company's Senior Vice President of Weight Management, highlights the "four pillars" of weight management: nutrition changes, activity, behavior modification, and medication. The program aims to reduce bias and stigma around weight, offering accessibility and comfort in discussing weight-related concerns through telemedicine. CEO Andrew Dudum acknowledges the rising consumer interest in weight loss, stating that demand for the new program has exceeded expectations. While GLP-1 agonists like Ozempic or Wegovy will eventually be included, the company prioritizes a thorough understanding of their supply chains and proper usage before integration.

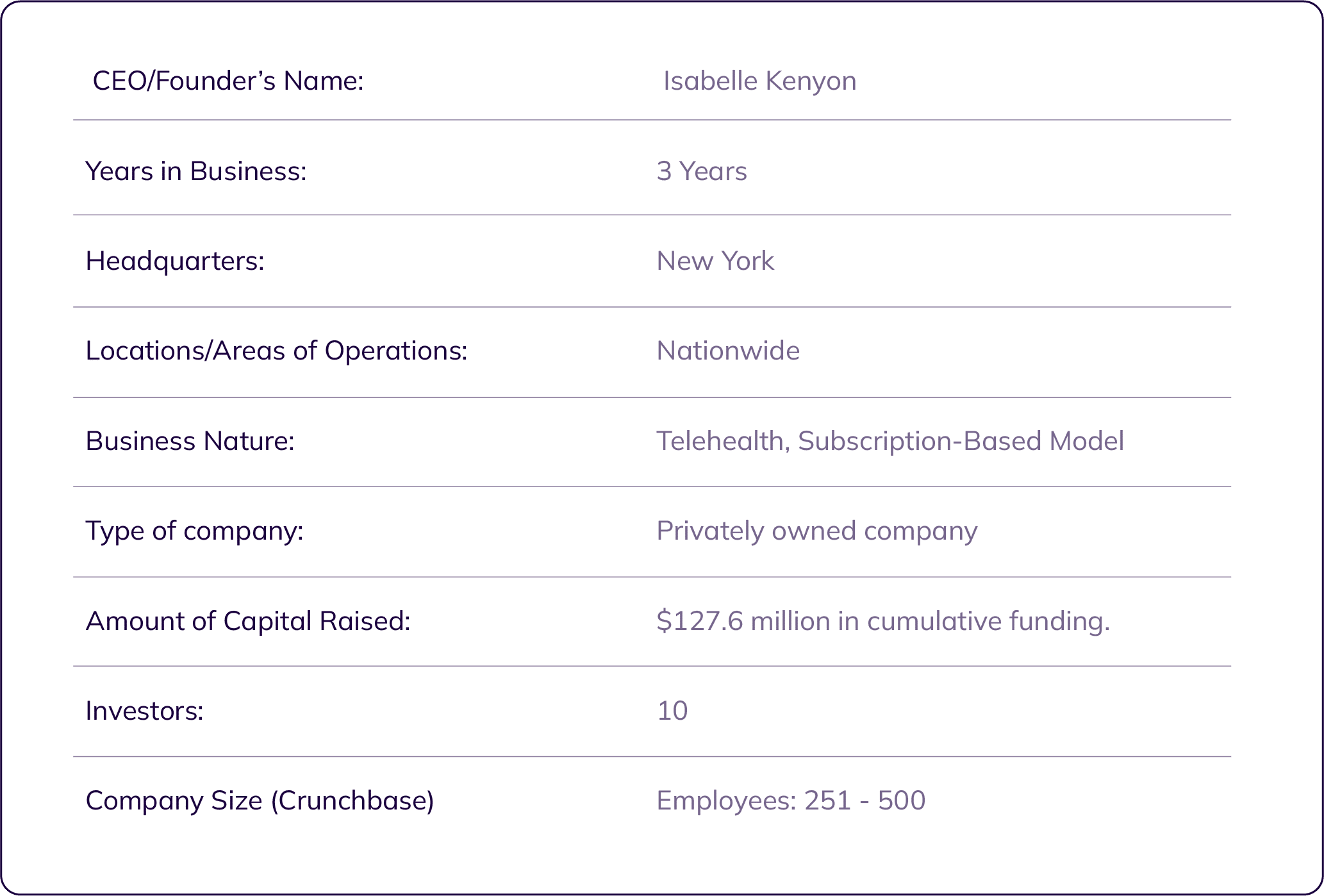

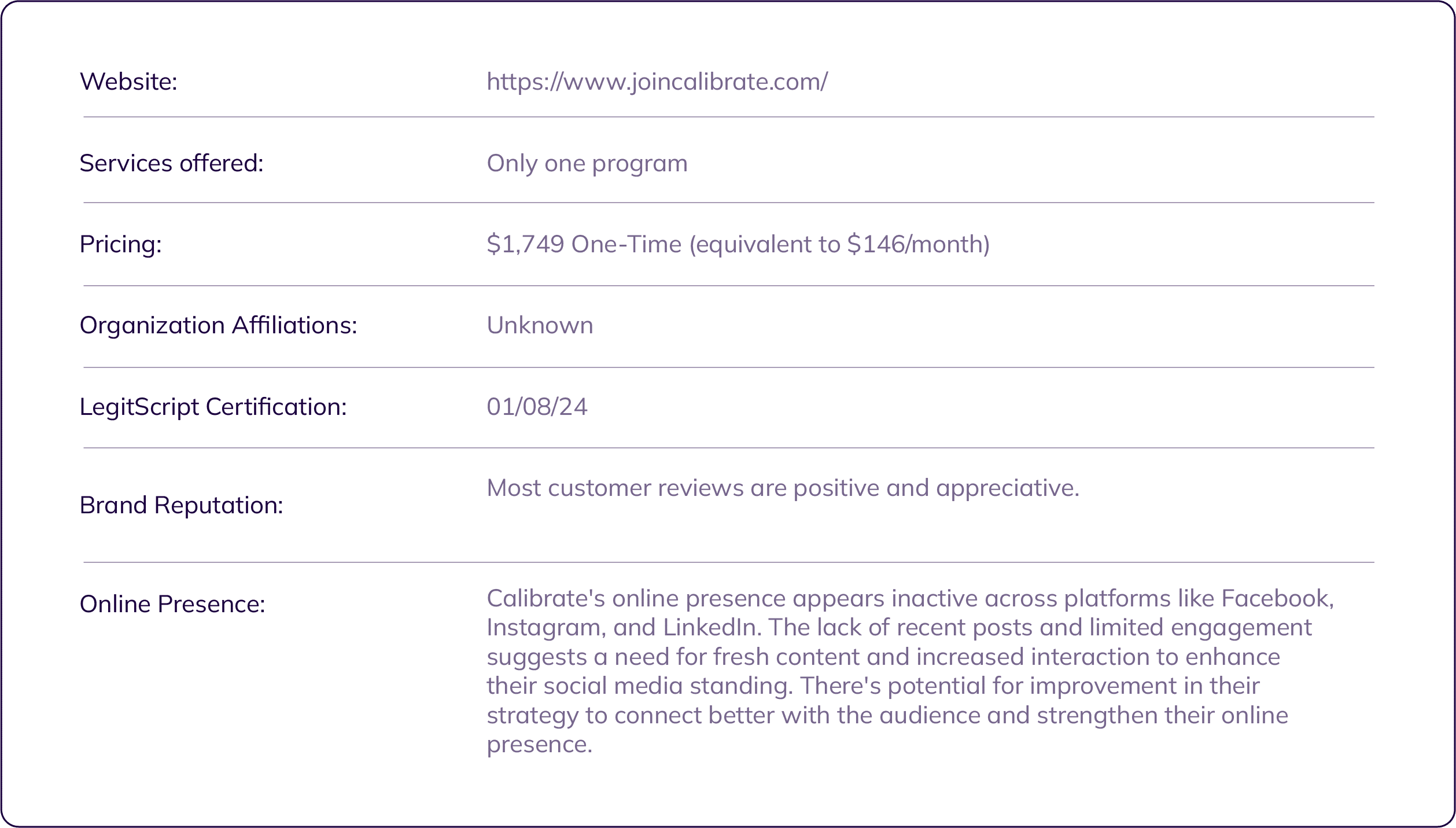

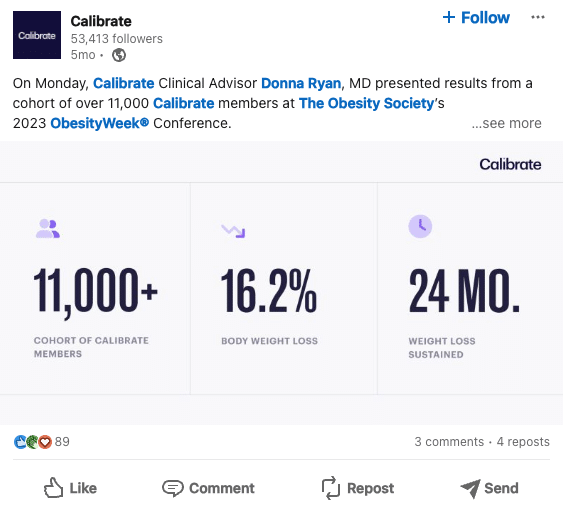

Company Overview

Financial / Investors

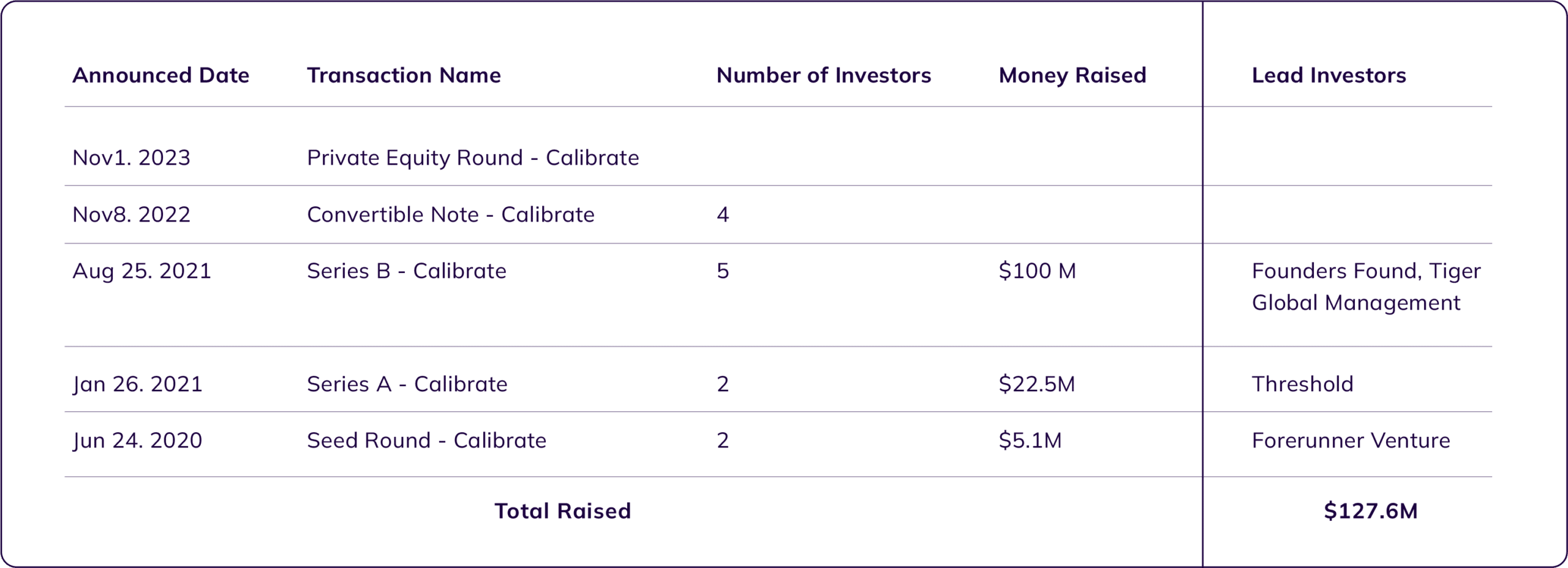

The total capital raised across these rounds amount to $127.6M, showcasing Calibrate's progressive financial growth and the diverse funding strategies they employed over time.

Private Equity Round - November 2021:

A private equity transaction took place in November 2021, signaling Calibrate's approach to raising funds through direct private investments.

Data and figures by: Crunchbase.com

Convertible Note

November 2021

Alongside the private equity round, Calibrate engaged in a convertible note transaction with four investors. Convertible notes are short-term debt instruments that can be converted into equity.

Series B Transaction

August 2021

Calibrate successfully raised $100M in an August 2021 Series B transaction. This round involved five investors, notably led by Founders Fund and Tiger Global Management. Series B rounds typically occur when a company has progressed beyond the initial stages and is in the phase of scaling its operations.

Series A Transaction

January 2021

In January 2021, Calibrate secured $22.5M in a Series A transaction. This round involved two investors, with Threshold being the primary lead investor. Series A rounds often follow seed funding and are aimed at further developing the product or service.

Seed Round

January 2020

Initially, in January 2020, Calibrate embarked on its funding journey with a seed round that raised $5.1M. Forerunner Ventures led this round, which is typically the first official equity funding stage for startups.

Data and figures by: Crunchbase.com

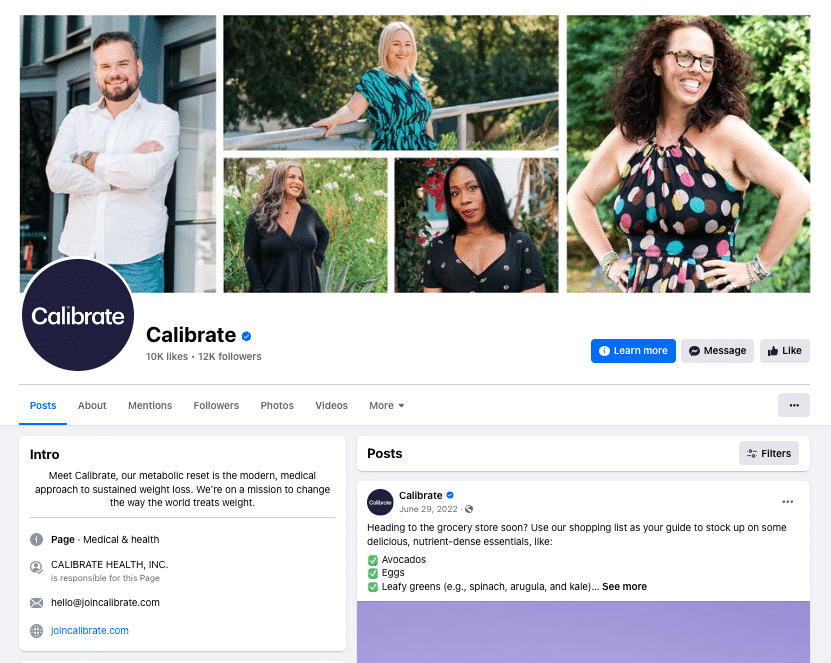

June 2022

Followers 12K

Last Post Publish: June 2022

0 active paid campaigns

Calibrate has not posted on Facebook for over a year and lacks interaction with recent followers, such as comments and likes. Previously, their content was informative and generated a good number of comments per post. The absence of recent posts suggests a lack of activity on this platform, which could impact their connection with the audience.

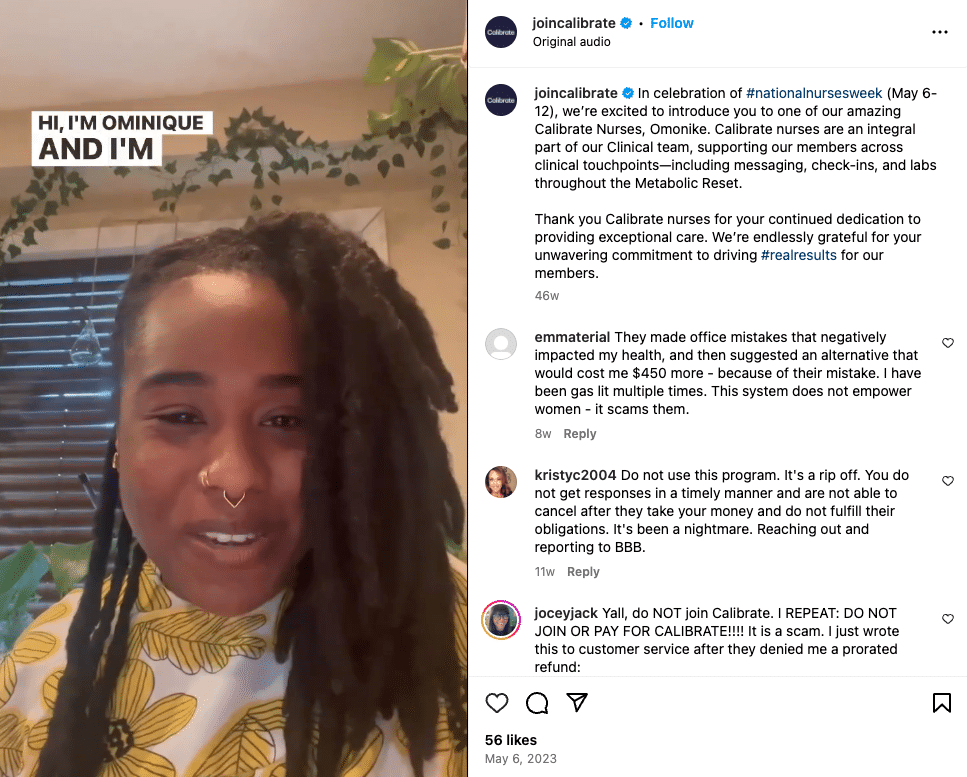

May 6, 2023

Followers 2394

Following 4

Post: 48

On Instagram, they have 2,373 followers and have made 49 posts. The posting frequency varies between 2 and 5 business days. In the last 6 months, the maximum number of likes on a post was 27, while the average ranges between 6 and 8 likes per post. In most posts, there are no comments observed. The content is characterized as informative.

Oct, 2023

Followers 3K

Post Frequency: Low (Monthly)

On Instagram, they have 2,373 followers and have made 49 posts. The posting frequency varies between 2 and 5 business days. In the last 6 months, the maximum number of likes on a post was 27, while the average ranges between 6 and 8 likes per post. In most posts, there are no comments observed. The content is characterized as informative.

Press

The articles shed light on various aspects of the company's recent activities. One article describes the legal restructuring following challenges such as GLP-1 drug shortages. Despite raising over $160 million in funding since its founding in 2020, Calibrate has faced hurdles in providing medications, user dissatisfaction, and payer resistance to covering prescribed drugs. The restructuring aims to bolster financial stability and achieve profitability.

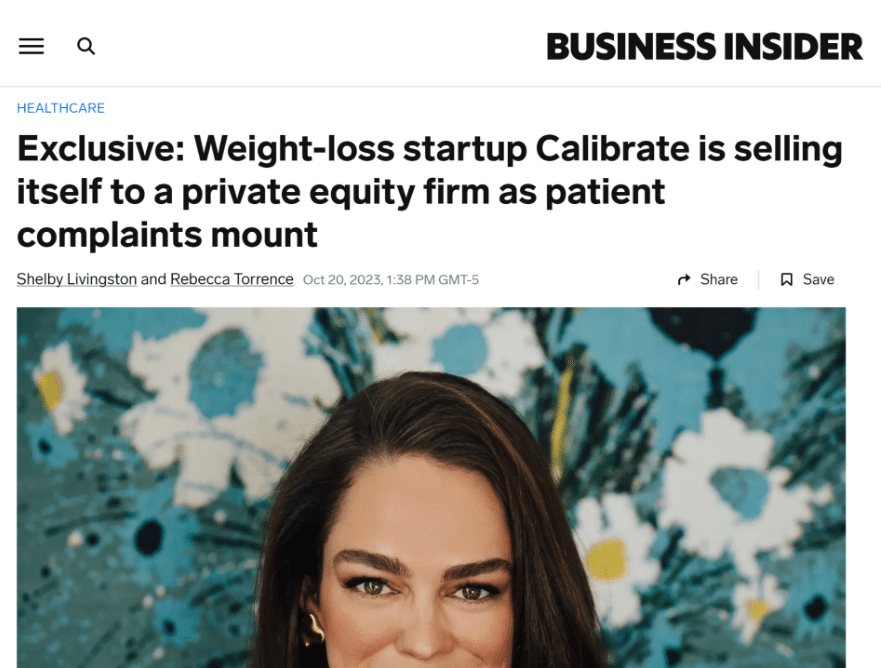

The sale of Calibrate to the private equity firm Madryn Asset Management, announced through internal communication, is also noteworthy. This decision stems from member complaints about delayed responses and difficulties in obtaining weight loss prescriptions, resulting in substantial refunds to members in 2023. Recently, Calibrate has pursued partnerships with employers, including a deal with OptumRx to offer its weight loss platform to FedEx employees starting in August.

Press

Weight loss company Calibrate, known for its program combining GLP-1 drugs with personalized metabolic health coaching, has undergone a legal restructuring amid challenges, including GLP-1 drug shortages and mounting user complaints. The startup, which recently experienced significant layoffs, has announced the change in ownership and a new financial commitment from Madryn Asset Management and other existing investors. Calibrate, founded in 2020, has raised over $160 million in funding but has faced difficulties, including struggles with providing medications, increasing user frustrations, and payer reluctance to cover medications. The restructuring aims to strengthen the company's financial position and achieve profitability.

Press

Calibrate is selling itself to the private equity firm Madryn Asset Management, as reported by Insider. The sale announcement was made through a Slack message to the startup's staff, with the price and other terms of the deal yet to be disclosed. Calibrate, which prescribes weight-loss drugs like Ozempic and Wegovy along with coaching, plans to restructure its business as part of the sale. The restructuring includes new financial commitments from Madryn Asset Management and other previous investors. The sale comes amid member complaints about delays and difficulties in obtaining responses and weight-loss prescriptions. Calibrate has refunded millions of dollars to members in 2023. The company has recently focused on securing more deals with employers, including a deal with OptumRx to provide its weight-loss platform to FedEx employees starting in August.

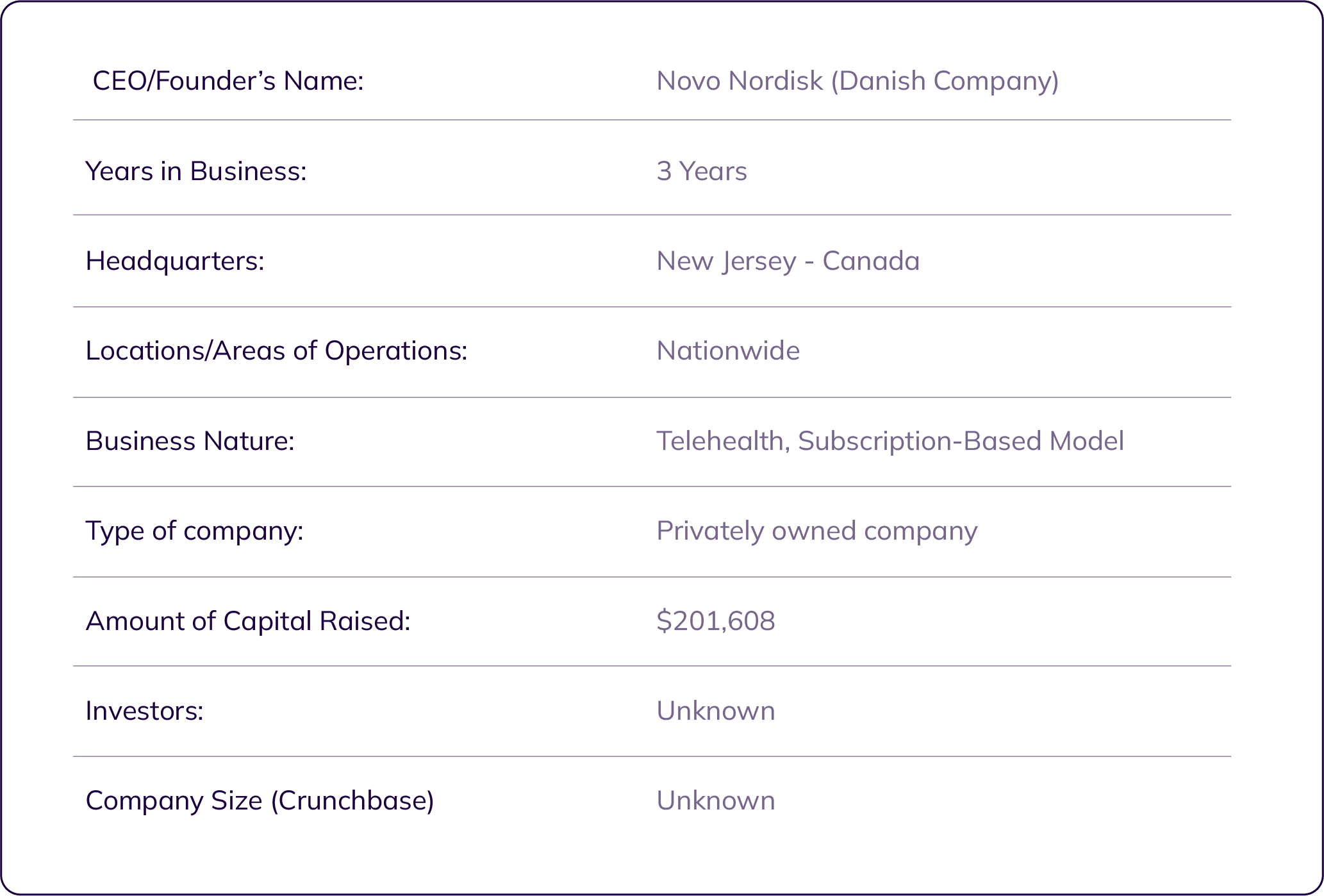

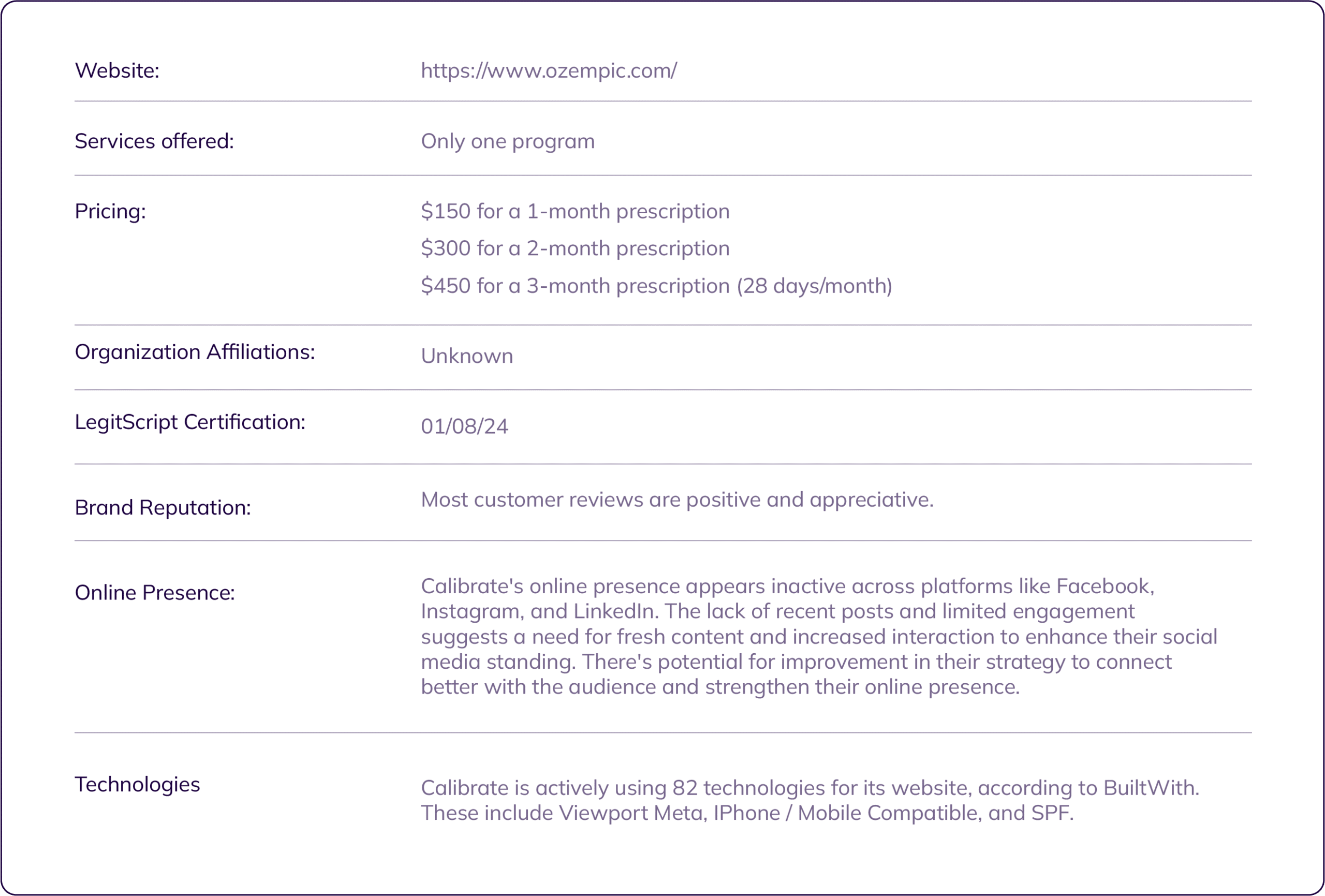

Given that Ozempic is not a direct competitor but rather a supplier to both our competitors and us, we have conducted an analysis of its current market position. This is because it is part of Novo Nordisk, the company behind Ozempic. The purpose of this analysis is to understand the direction Ozempic aims to take and to evaluate other alternatives in brands or models to offer to the patients.

One standout statistic was Ozempic sales increasing by 58% annually in 2023. Novo Nordisk's shares rose significantly, outperforming the European Stoxx 600 index. The firm holds nearly 50% market share for insulin used by diabetics.

Novo Nordisk, a Danish pharmaceutical giant, reported its most significant quarterly profits and sales in history, attributed to the popularity surge of its weight loss and diabetes drugs, particularly the injectable GLP-1 semaglutide drugs Ozempic and Wegovy. These drugs accounted for $4.8 billion in sales during the third quarter, contributing to 52% of Novo Nordisk's total revenue of $23.6 billion in the first nine months of 2023, compared to 36% during the same period last year.

The increasing popularity of weight loss drugs like Wegovy and Ozempic has significantly boosted Novo Nordisk's market capitalization from $230 billion to over $430 billion, surpassing Denmark's annual economic output.

Company Overview

Brand Immersion

Brand Landscape

Promises and communication of

your brand

Brand Guideline

How to use the

Dr.nuMe brand

Messaging

What and how Dr.nuMe should communicate

Persona Profiles

Get to know Dr.nuMe target audience

Dr.nuMe 2025 Copyright © | Created by Emerge BBCO